With some estimates valuing the generative artificial intelligence (AI) market at $110 billion by 2030, Amazon is getting involved in the action. 🤖

Today the tech giant announced Amazon Bedrock, which provides a way to build generative AI-powered apps using pre-trained models from startups like AI21 Labs, Anthropic, and Stability AI. However, rather than taking on the risk of building its own AI models, it’s allowing third parties to host their models on Amazon Web Services (AWS).

Essentially, it provides the pickaxes and shovels for the current gold rush. That’s likely because CEO Andy Jassy said that ‘really good’ A.I. models take ‘billions of dollars’ to train. ⚒️

The company’s new offering differs from competitors like Replicate, Google Cloud, and Azure because it’s primarily aimed at large customers building “enterprise-scale” AI apps. And although model licensing terms and hosting agreements have not been revealed, its likely vendors were attracted by Amazon’s overall reach and potential revenue-sharing opportunities.

Still, the environment around AI remains murky, leaving many companies on the sidelines until there’s more regulatory clarity. Just this week, China, Italy, and other countries have taken action against industry leaders like OpenAI and drafted rules governing the technology’s use in their borders. Even Congress is laying the groundwork for regulating AI in the United States. 📝

Despite the uncertainty, AI-related stocks remain all the buzz. Especially those with AI in their ticker symbol or name. $AI, $GFAI, $BRFG, and several others have been trending heavily on the platform and the internet. ⚡

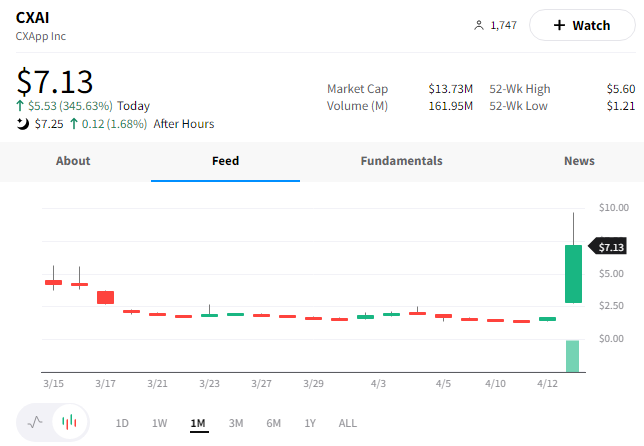

$CXAI popped on the scene today, rising over 350%. 📈