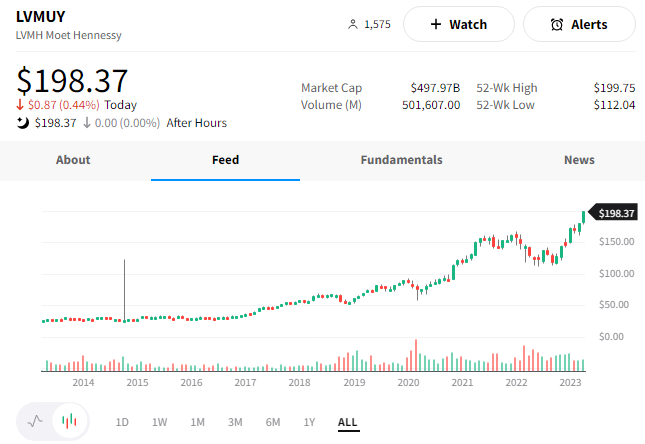

Luxury goods giant LVMH is the first European company to surpass $500 billion in market value. 💰

The parent company’s brands include Louis Vuitton, Moet & Chandon, Hennessy, Givenchy, Bulgari, and Sephora. And its 17% rise in first-quarter sales more than doubled analyst estimates. That, plus a profit from recurring operations of 21.1 billion euros, marked its second consecutive year of record results. 📈

As for the driver? Higher-income consumers continue to spend despite uncertainty in the economy. Additionally, China’s Covid reopening fueled a rebound in travel by high-end spenders.

The results send $LVMUY shares to fresh all-time highs, further boosting CEO Bernard Arnault’s net worth (currently the world’s richest person). 🤑

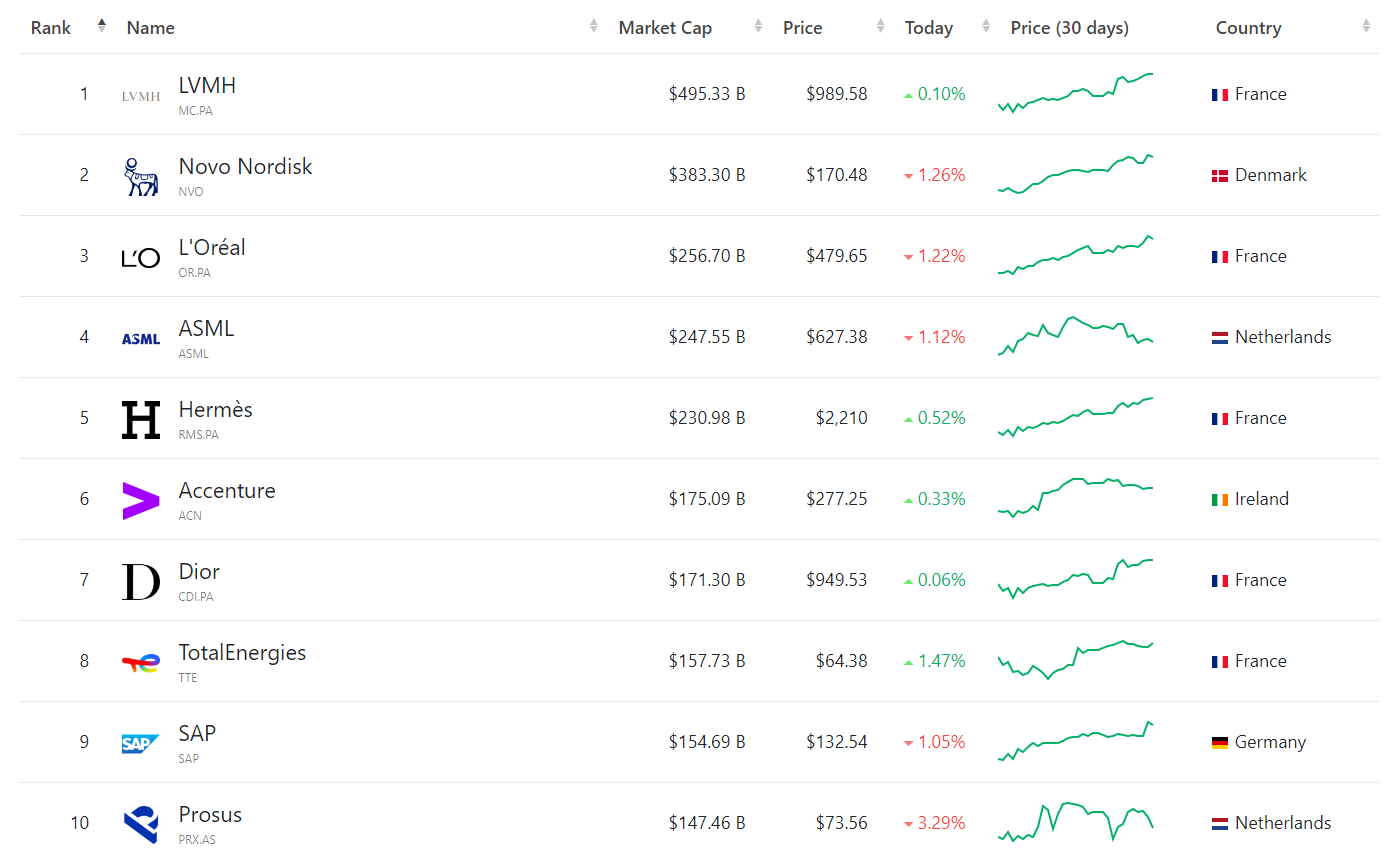

This begs the question, if LVMH is the first to pass $500 billion, what else is on the list? You can find a complete list here, but below are the top 10. 👇