Ever since the collapse of Silicon Valley Bank (SVB), First Republic Bank has been investors’ next major worry.

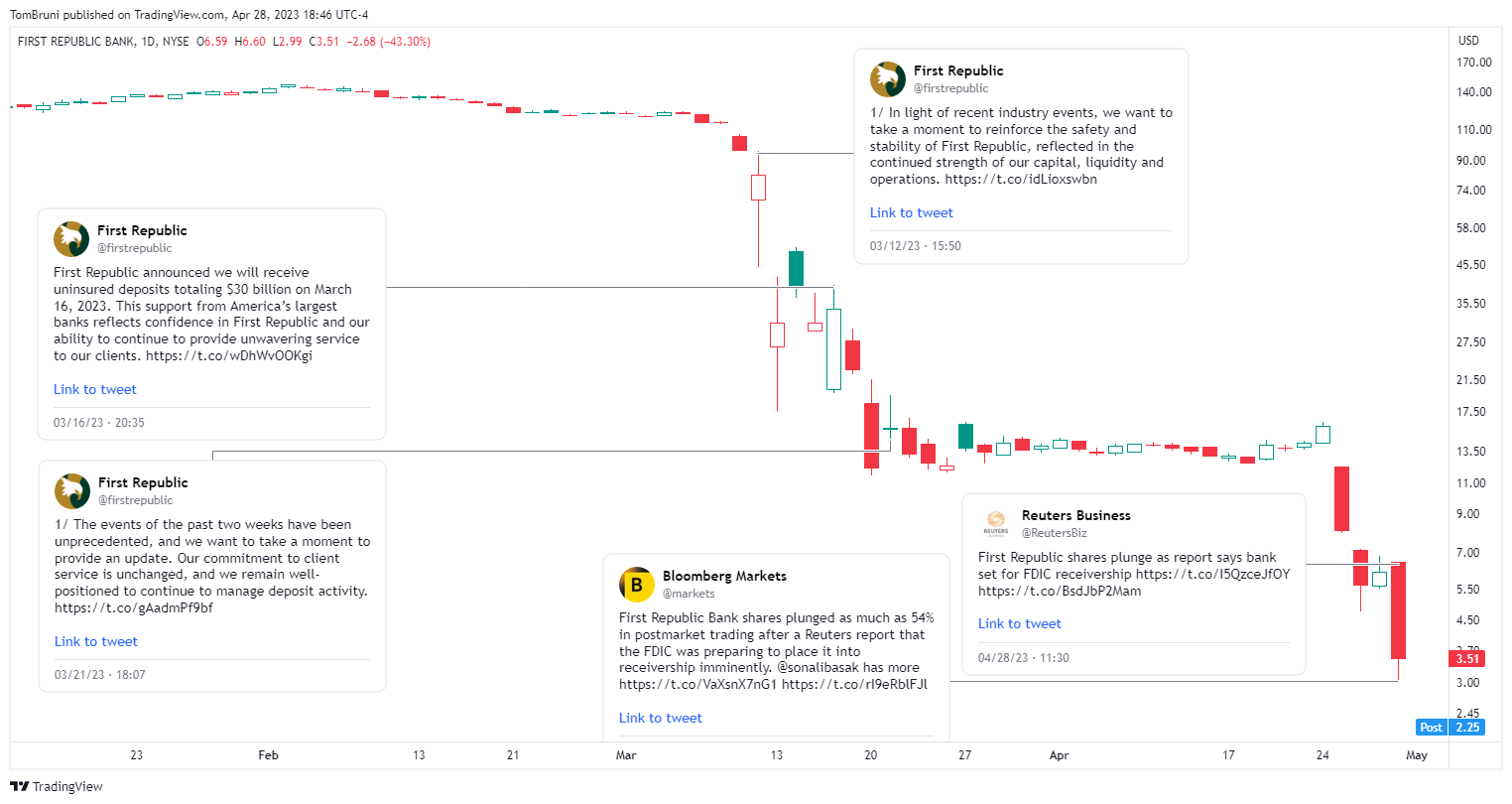

For those not caught up on the regional bank’s journey, the chart below highlights some key moments over the last two months. 👇

Essentially its interest rate risk and depositor base were similar to the banks that collapsed. As a result, investors and depositors pulled their funds from the bank and exacerbated the issues. A $30 billion bailout from eleven of America’s largest banks and a selling of assets was supposed to stem losses and restore confidence. However, the last few weeks have shown those efforts weren’t enough. 😬

Today the stock plummeted to fresh lows on a Reuters report that claimed the U.S. Federal Deposit Insurance Corporation (FDIC) is preparing to place it under receivership “imminently.” 😱

Reuters previously reported that a government-brokered rescue deal was in the works. However, its source today said the FDIC has decided the regional bank’s position has deteriorated, and there is no more time to pursue a private sector rescue. ⌛

If the reports are true, it will be the third U.S. bank to collapse since March. At its peak in November 2021, it was worth over $40 billion. And today, its market cap ended at $653 million as investors positioned themselves for official receivership news over the weekend. 📰

Also, it’s worth noting the Fed released a report on the SVB collapse that primarily blames the bank’s managers. We wonder what they’ll say about this situation… 🤔