With the recent selloff in defensive sectors like utilities, consumer staples, real estate, and telecom, many of these stock’s dividend yields are jumping to multi-year or multi-decade highs. However, the reason their jumping isn’t the one that investors prefer. 🙁

A stock’s indicated dividend yield could rise by the company raising its dividend payout amount or the stock price falling. And recently, most of the dividend yield gains have come from falling prices.

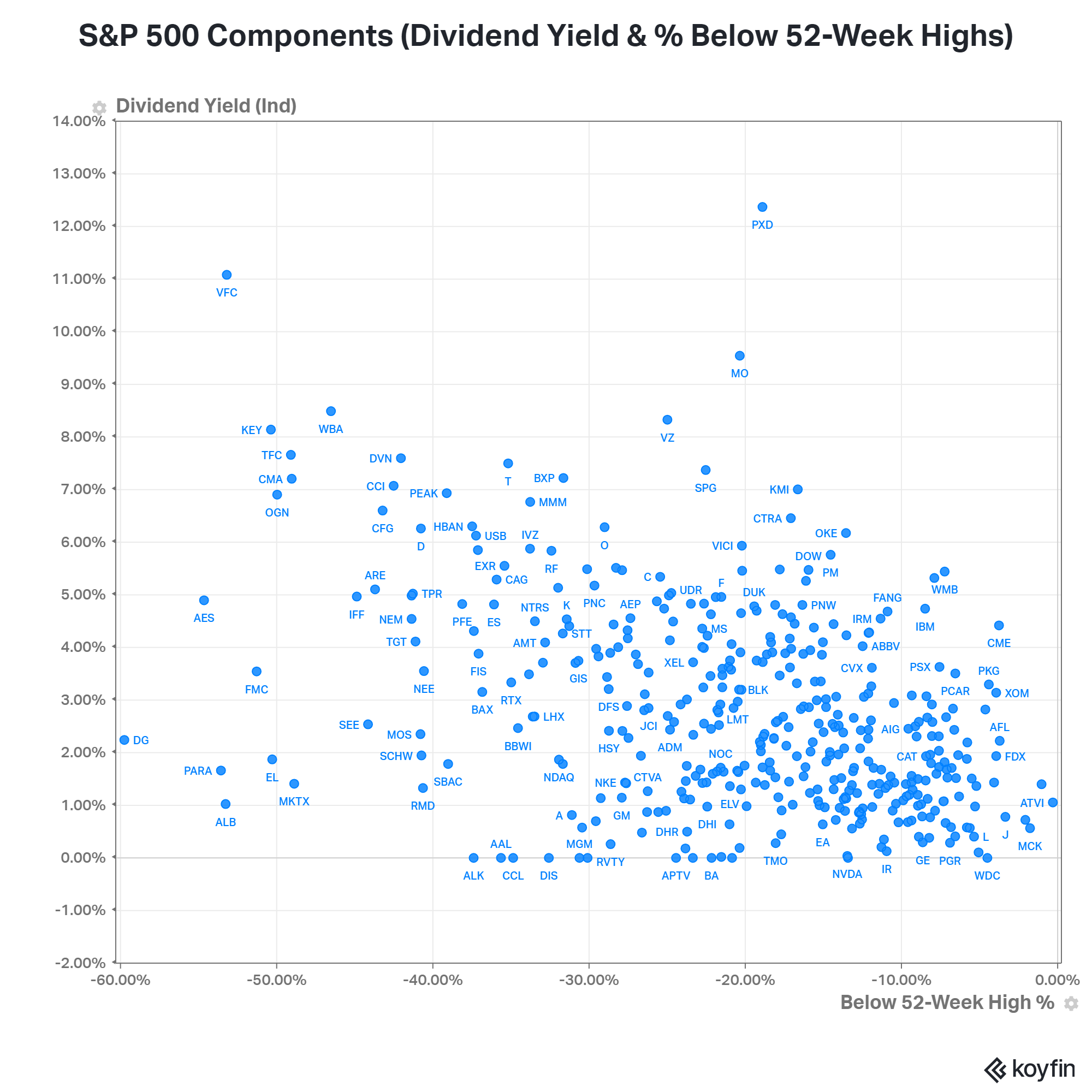

Below is a scatter plot of S&P 500 components with their dividend yield and the stock’s drawdown from 52-week highs. At the extremes, we can see stocks like Altria ($MO), Verizon ($VZ), Walgreens Boots Alliance ($WBA), VF Corp ($VFC), and other big names catching investors’ attention.

Rising yields may seem like an attractive hook for investors looking to “buy the dip.” And they certainly were in the past “there is no alternative” (TINA) era of low-interest rates. But with the risk-free rate above 5%, many investors are abandoning these traditionally “safe” assets as they sell off with the bond market. 👎

The reason right now is simple. If you can get the same or higher yield in a risk-free (or lower-risk) product like a money market or high-yield savings account, there’s no need to take the equity risk associated with owning these stocks. Of course, they’re also giving up some potential upside there. But with fear ruling the market, many investors are willing to make that tradeoff for now.

We’ll have to wait and see how this develops. It’s unclear where interest rates will ultimately settle, and the stock market will find its footing. But after experiencing quite a bit of pain in traditionally “safe” stocks and assets this year, it’s clear some investors are taking their lumps and moving on. 📝