While the media and Wall Street are obsessed with tech unicorns, there appears to be trouble in dinosaur land. Let’s take a look. 👀

It’s no secret that telecom companies have been struggling over the last few years. Driving the weakness is a slowdown in its core business as U.S. telecom growth slows and competition heats up. And on the cost side, expensive up-front investments in nationwide 5G service weighed on profits. Meanwhile, their legacy media businesses, meant to diversify their business, face increased competition, content costs, and reduced demand. 🔻

As a result, stocks like Verizon and AT&T have suffered significant drawdowns. And losses continued today after an investigation from The Wall Street Journal revealed that U.S. phone companies have abandoned networks of cables covered in toxic lead.

The extent of this issue is not fully understood, nor are the financial ramifications, leaving a lot of uncertainty for investors. And with these stocks already underperforming the broader market in a big way, many are using this as another reason to sell and allocate capital elsewhere.

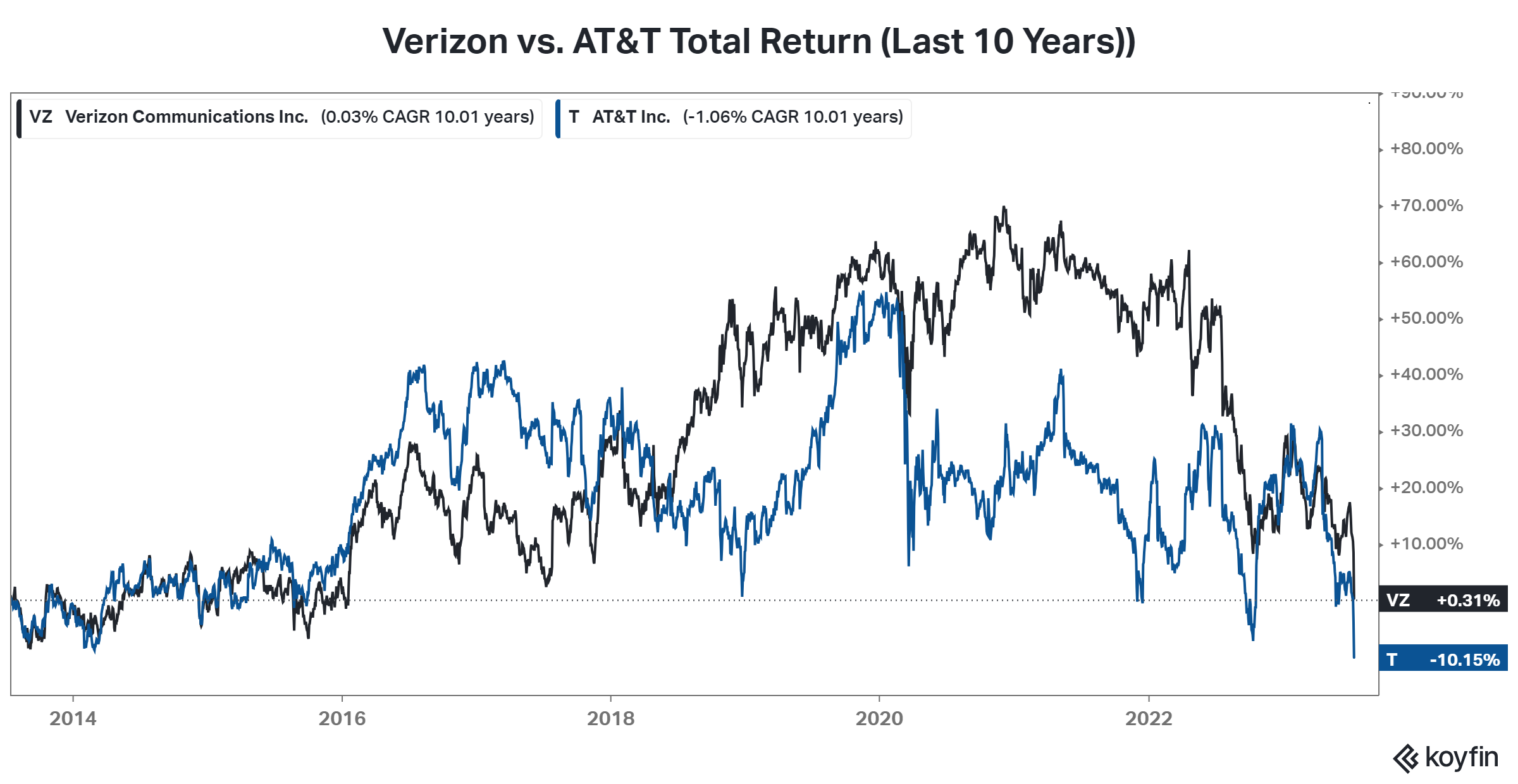

With today’s declines, it’s become a “lost decade” for these stocks as both of their total returns fall into negative territory. On a price basis, Verizon shares hit their lowest level in 13 years, while AT&T made new 30-year lows. Yikes. 😬

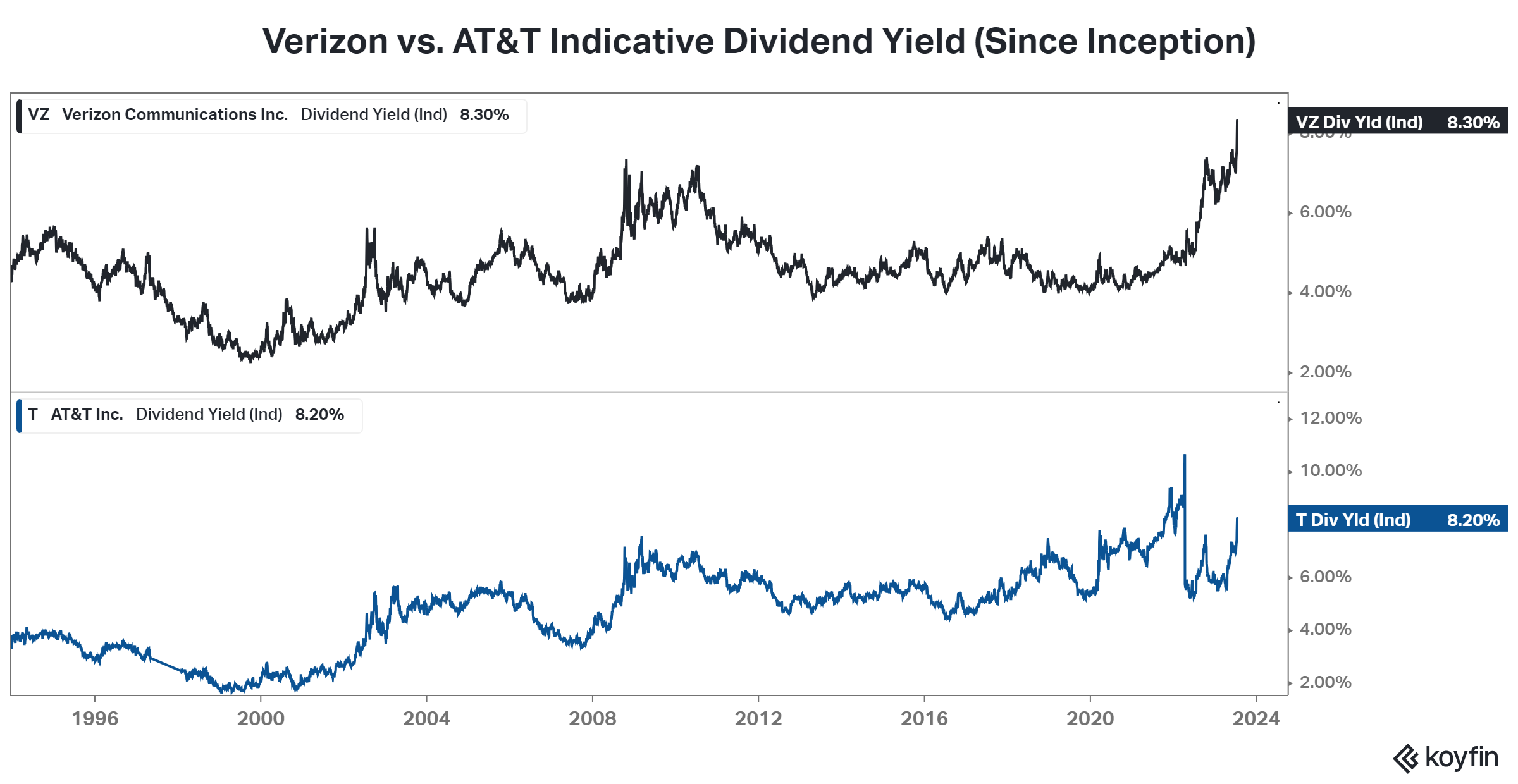

While most investors acknowledge the industry’s challenges, some can’t help but eye the juicy dividend yields. Verizon’s indicative dividend yield for the next twelve months soared to new all-time highs above 8%, while AT&T’s reached heights only seen last year before its WarnerMedia spinoff led to a roughly 50% dividend cut. 😮

Soaring dividend yields are great when growing profits and shareholder payouts drive them. They’re not so great when driven by sharp declines in share price. As a result, many investors will be digging into the numbers to identify whether these dividends can truly be maintained or if they’re one giant bull trap. 🕵️♂️

Time will tell. But for now, service is definitely spotty in telecom stock land. And with so many other stocks working in the current environment, many market participants are looking elsewhere for opportunities. 🤷