Until today, only six U.S.-listed companies had reached a market capitalization of $1 trillion or more at one point in their history. And one abroad, Saudi Aramco. However, the recent hype over artificial intelligence (AI) helped propel retail investor favorite Nvidia onto that list…at least intraday. 🤩

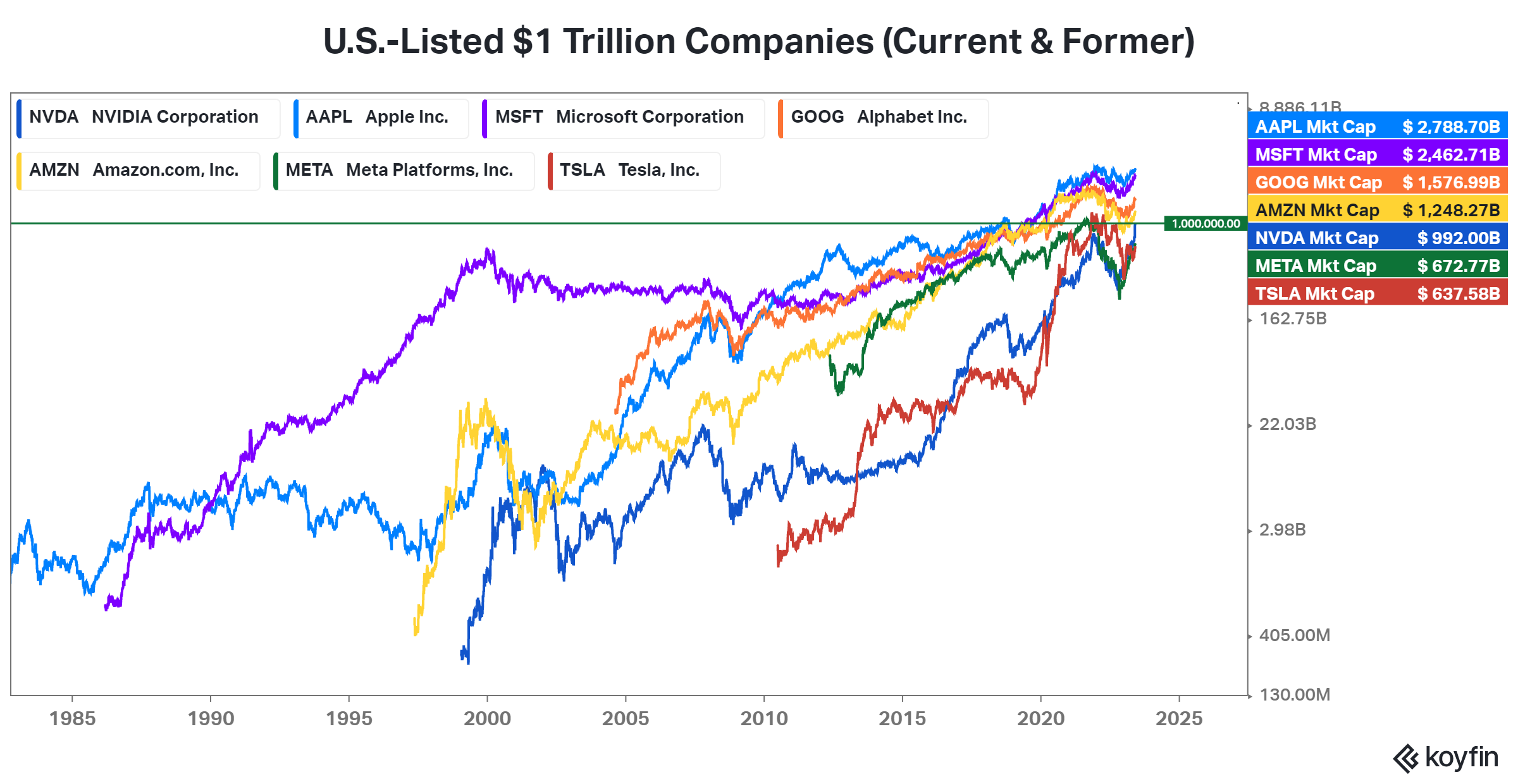

The chart below shows it is joining the ranks of Apple, Microsoft, Google, and Amazon, which are still above $1 trillion. And Tesla and Meta, which briefly surpassed that mark in 2021 but have since fallen from grace. 👇

Where it goes from here is anyone’s guess. And believe us, people are guessing… But for now, we’re just stopping to smell the roses at this milestone. 🌹

Time will tell what’s (or who) is next. Berkshire Hathaway is closest at $705 billion, followed by TSMC at $530 billion, Visa at $465 billion, United Health at $447 billion, and Exxon Mobil at $421 billion. The race is on… 👀