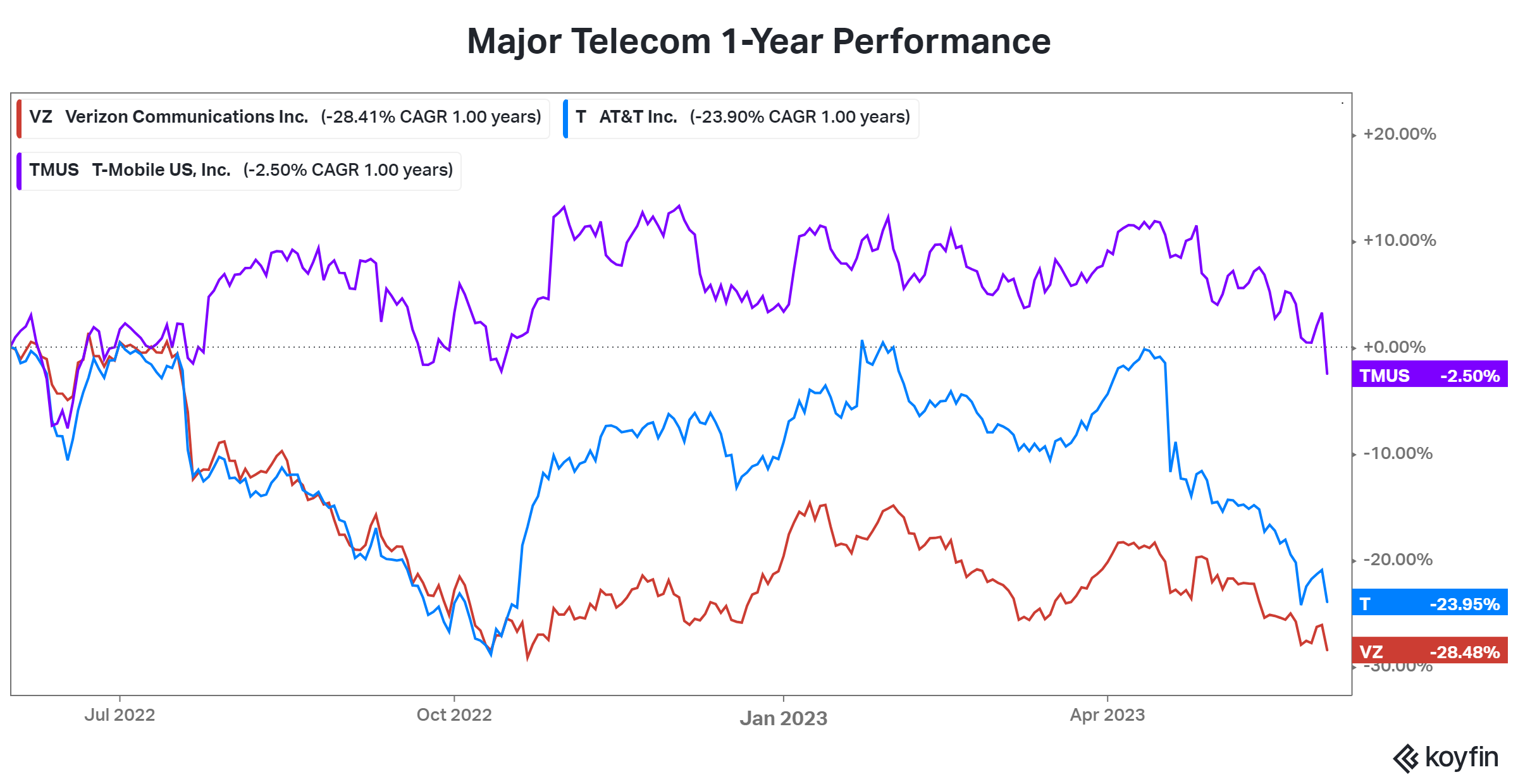

It’s been a rough environment for telecom stocks, particularly the largest ones with diversified media businesses. However, things may get more challenging as Amazon enters the fray. So let’s see what today’s news and initial reaction were. 👇

The original report was from Bloomberg, which stated that Amazon was in talks to offer free or discounted mobile service to U.S. Prime Members. It indicated the tech giant had been talking with wireless carriers, negotiating with Verizon, T-Mobile, and Dish Networks to get the lowest wholesale prices possible. 📱

However, T-Mobile and Verizon both denied discussions, and Dish declined to comment. That’s likely because this represents a catch-22 for them.

While this offering would give the big carriers another major distribution network to expand their 5G networks, it would come at the cost of margins. The big carriers’ unlimited plans start at roughly $60. So if Amazon does offer a free or $10/month plan to its prime members, that would pose significant competition to those regular-priced bundles. 🛒

The move would likely mean more customers on their networks but less profit per customer. 🔻

Ultimately, the telecom giants will have difficulty saying no to Amazon for several reasons. First, they need new distribution channels to grow the 5G network. And second, the tech giant has shown it’s willing to lose billions on certain member perks to maintain its edge against Walmart+ and other alternatives. If Amazon wants to enter a specific industry, it will do it, with or without cooperation.

So these companies will likely cooperate; it’s just unclear how the final deal will look.

In the meantime, investors are ratcheting down their earnings expectations. That weighed on already heavy stock prices. 📉