A short squeeze of beaten-down stocks is just what “the Docusign” ordered. Let’s see what’s happening in several beaten-down tech names and what it says about the market environment. 👇

First up is online car retailer Carvana, which provided investors with updated second-quarter guidance today. The company said its cost-reduction efforts would boost results beyond prior expectations.

Executives expect adjusted EBITDA of more than $50 million in Q2, while analysts anticipated the company would break even. It also expects gross profit per unit (GPU) to be over $6,000, a new company record, and a 60% YoY increase. 🔋

$CVNA shares rallied 56% today, bringing its year-to-date performance to 423%. That said, the highly-shorted company is still down 93% from its all-time highs. 📈

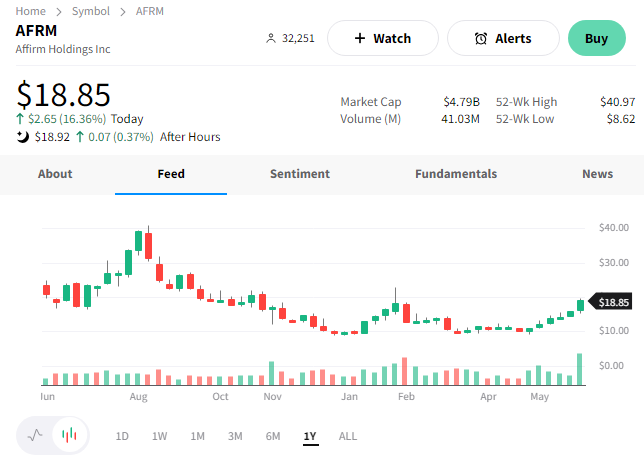

Buy now pay later (BNPL) company Affirm Holdings is also rebounding sharply. Yesterday the company announced a deal with Amazon to offer its “Adaptive Checkout” to all Amazon Pay merchants. $AFRM shares rose 16% today, bringing their year-to-date performance to 107%. 🛒

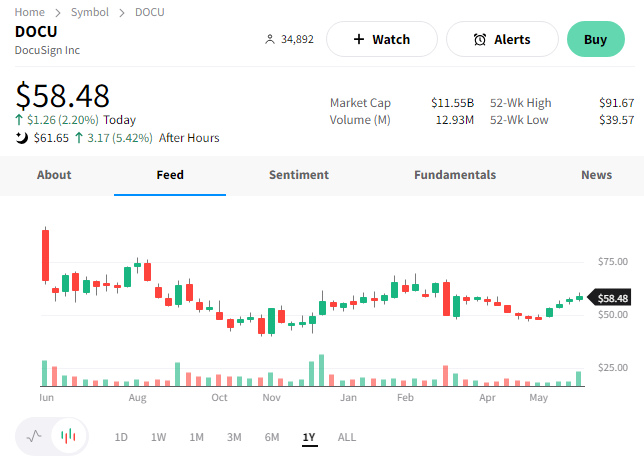

Lastly, e-signature provider DocuSign is jumping after reporting better-than-expected first-quarter results. The company’s adjusted earnings per share of $0.72 on revenues of $661 million topped the estimated $0.56 and $642 million.

Executives focused on their international growth, as the service is now in more than 180 countries with a YoY revenue growth of 17%. Meanwhile, it touted 1.4 million paying users and more than 1 billion users at the end of the quarter. Its second-quarter forecast was essentially in line with expectations. $DOCU rose 5% after hours. 🔺

Ultimately, the short squeezes occurring are a potential sign of two things. ✌️

The first is improving risk appetite as investors move from the safety of big-cap technology into more volatile market areas. And the second is that expectations for the underlying businesses of many of these stocks had gotten too dire. After all, if the economy is able to avoid a recession and inflation is under control, maybe some of these companies can stage a turnaround.

We’ll have to wait and see what happens to these companies long-term. But for now, traders are taking advantage of short-term trends in front of them. 🤷