It’s 13F and 13D filing season, which means that individual investors are looking closely at what portfolio changes institutional investors made last quarter. 🕵️

One of the biggest names people follow is Warren Buffett’s Berkshire Hathaway. And while you can view all of the financial giant’s holdings here, today, we will look at its recent purchases in the homebuilding sector. 🏘️

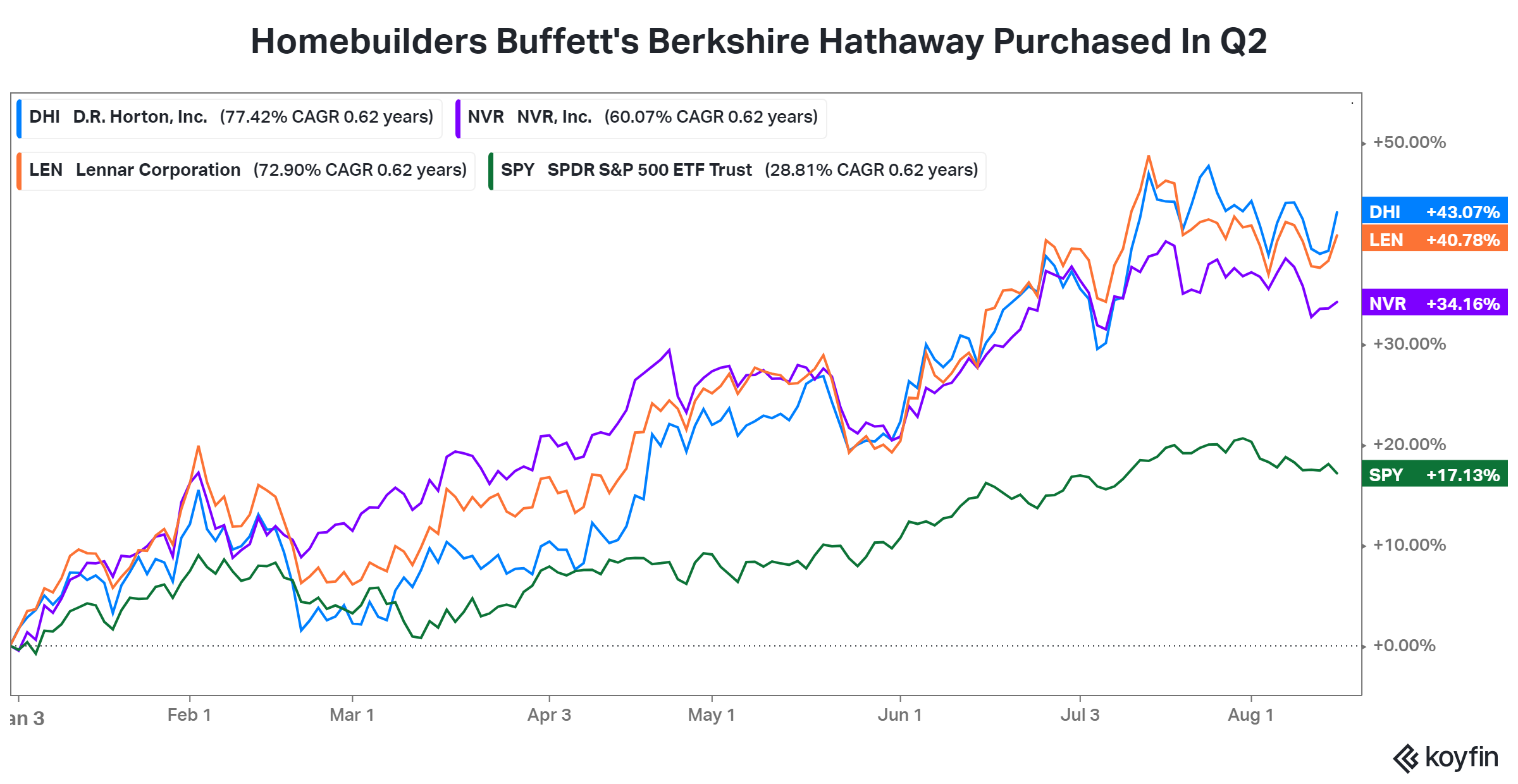

The filing indicated Berkshire bought $726 million worth of Dr. Horton ($DHI), $71 million of NVR Inc. ($NVR), and $17 million of Lennar ($LEN). These were all new additions to the portfolio, so they caught investors’ attention. However, it’s important to note that the $814 million total purchase represents less than 0.3% of the firm’s roughly $348 billion investment portfolio.

Nonetheless, the news sent shares of these names jumping today, adding to already substantial gains in 2023. As of this afternoon, all of these stocks have at least doubled the performance of the S&P 500. 😮

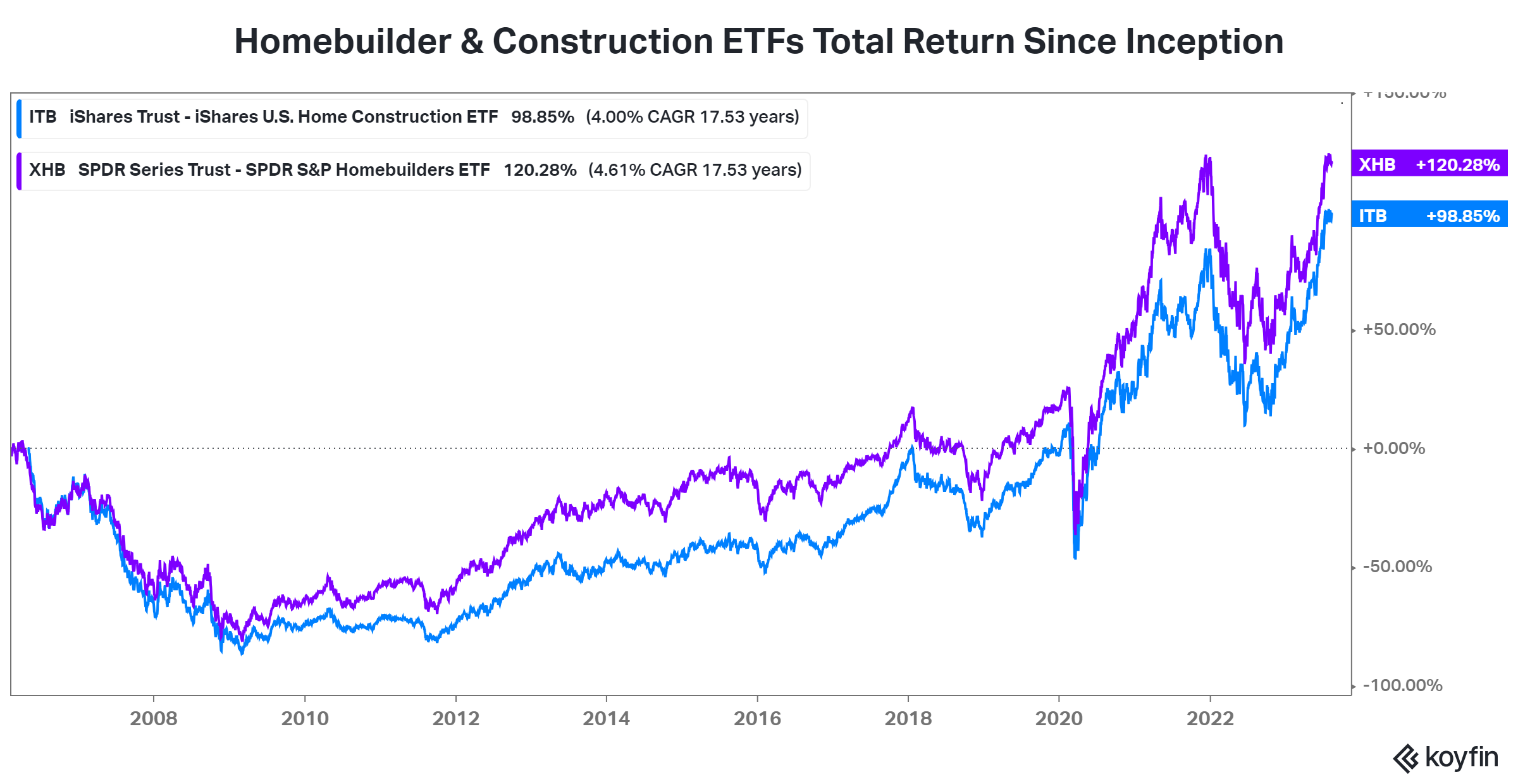

And from an industry perspective, it’s not just those stocks performing well. The two ETFs that track the industry closest are $ITB and $XHB, both sitting at all-time highs. 📈

We’ve long talked about investors’ bull case for homebuilders, but it’s essentially this. 👇

Roughly 90% of homeowners have a mortgage interest rate below 6% (or no mortgage at all). So with home prices at all-time highs and rates above 7%, they have minimal incentive to move. As a result, the existing home inventory for sale is historically low. So low that the median price of an existing home sold surpassed the median price of a new home sold last month (at roughly $416,000). 💸

That buoys demand for new housing, even at a time when housing affordability is at record lows. While fewer people are looking for homes today because of the affordability crunch, the demand that does exist is shifting to the new home market. Because why would you want to buy an old home that needs work when you can get a new one for a similar price?

With that said, it’s not all hunky-dory for homebuilders on the supply side. Although many have a solid backlog of orders, rising labor and material prices and low land availability put upward pressure on costs. 🔺

There’s clearly a structural issue in the housing market. The last financial crisis was caused by building too much (among other things). And the lack of sufficient construction since then has left a significant supply/demand imbalance in the market today.

What that all means for homebuilding stocks remains to be seen. But with the industry ETFs sitting at all-time highs and Buffett making a small bet on a few key players, this space has undoubtedly gotten investors’ attention. 👀

We’ll see if the excitement is enough to keep the stocks roaring higher. Or if this is a short-term top in prices as sentiment overheats. Time will tell. 🤷