As our article about the ultra-wealthy showed, 2023 was a great year for assets (especially the publicly traded ones). Let’s take a quick peek at how things panned out. 👇

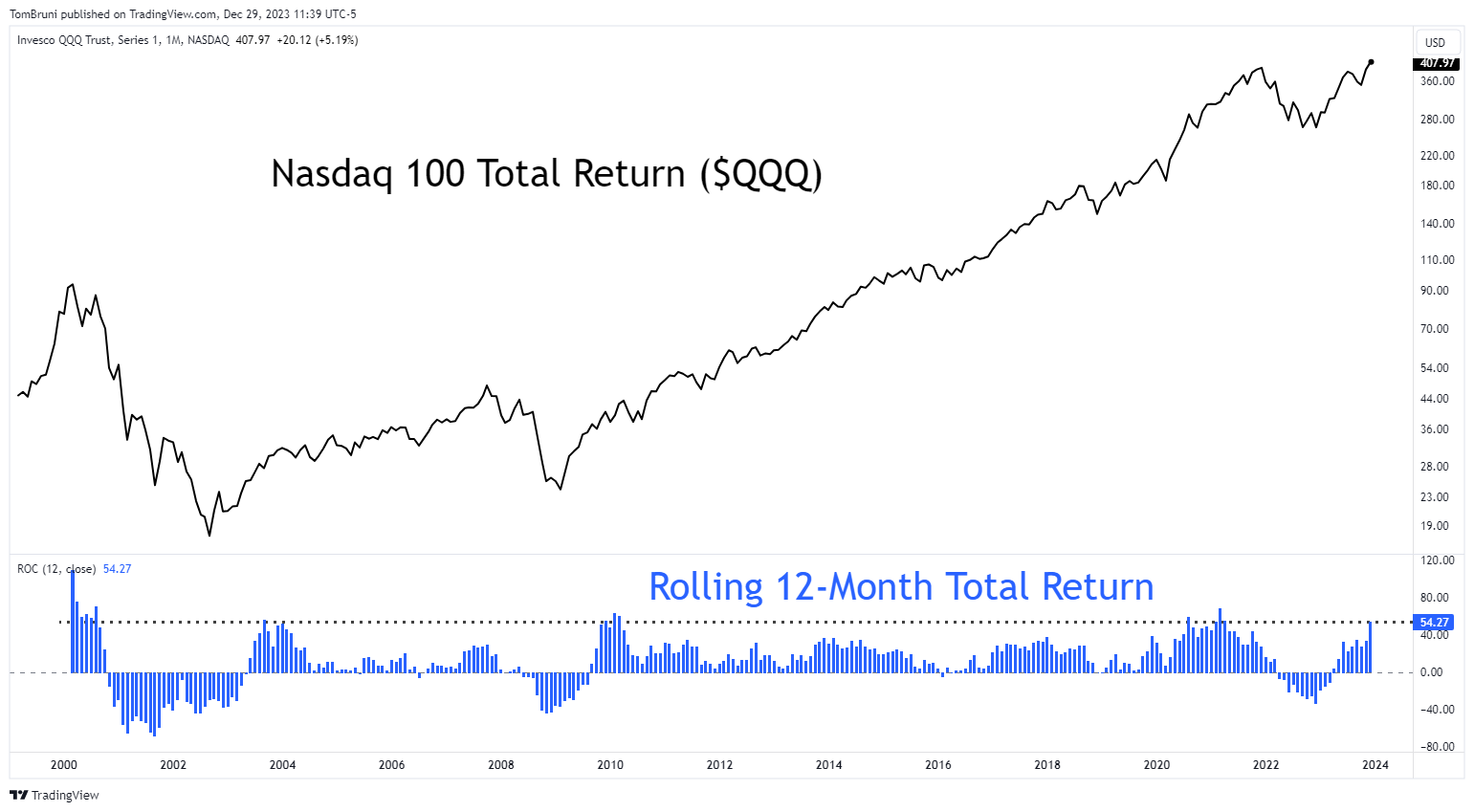

First, let’s start with the tech-heavy Nasdaq 100 index. The chart below shows that the index had one of its best rolling 12-month total returns in decades, rising 55%. The actual total return index also hit new all-time monthly closing highs, reiterating that bulls took back the momentum this year in a big way. 🤩

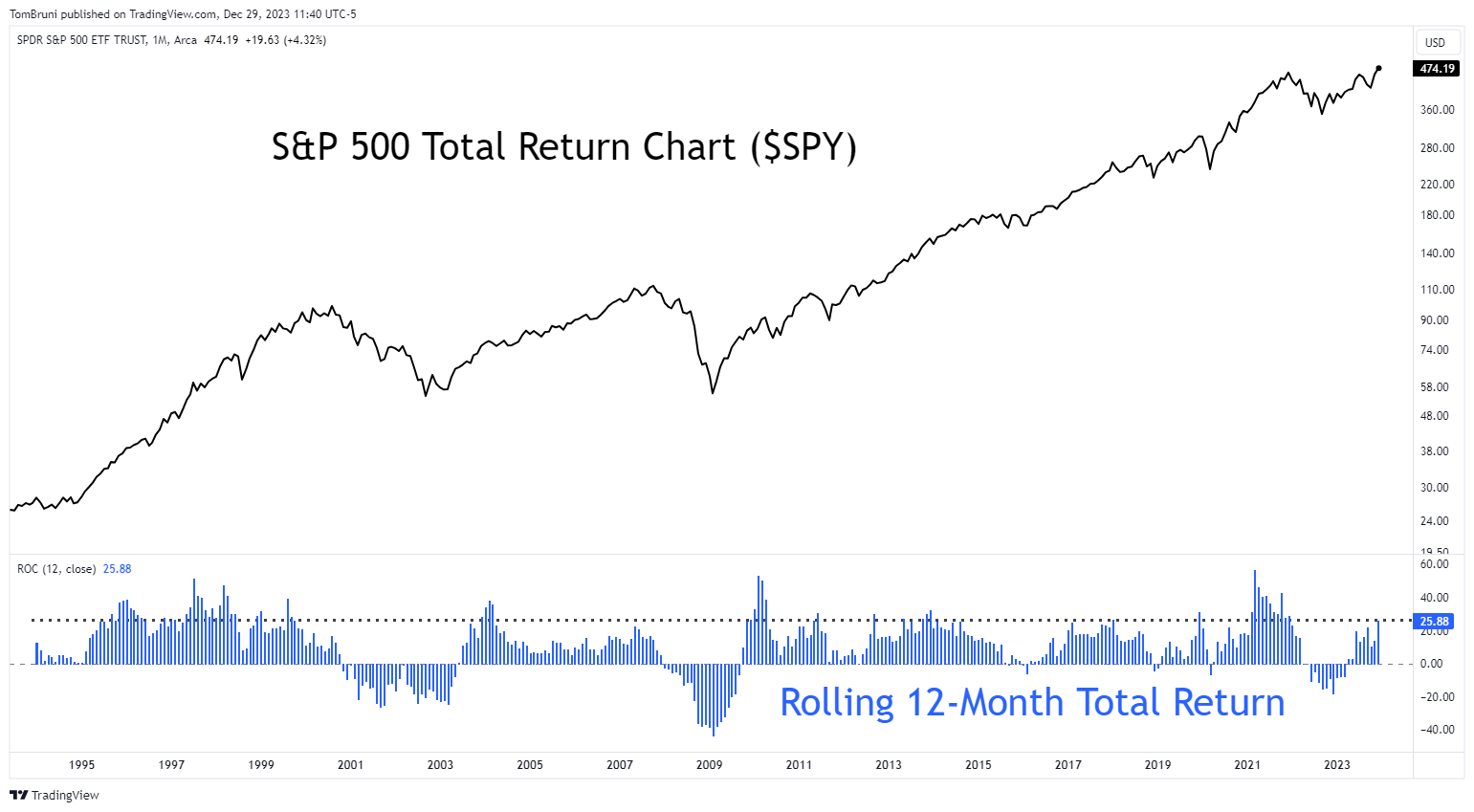

The S&P 500 total return index looked similar, rising 26%. What’s interesting to note is that this year’s performance isn’t as rare as many would expect. However, the caveat is past spikes in performance like this year’s typically came after periods of crisis or other bear markets.

Investors had to buy in the face of many risks to earn these big returns throughout history, and the last eighteen months were no different. 😱

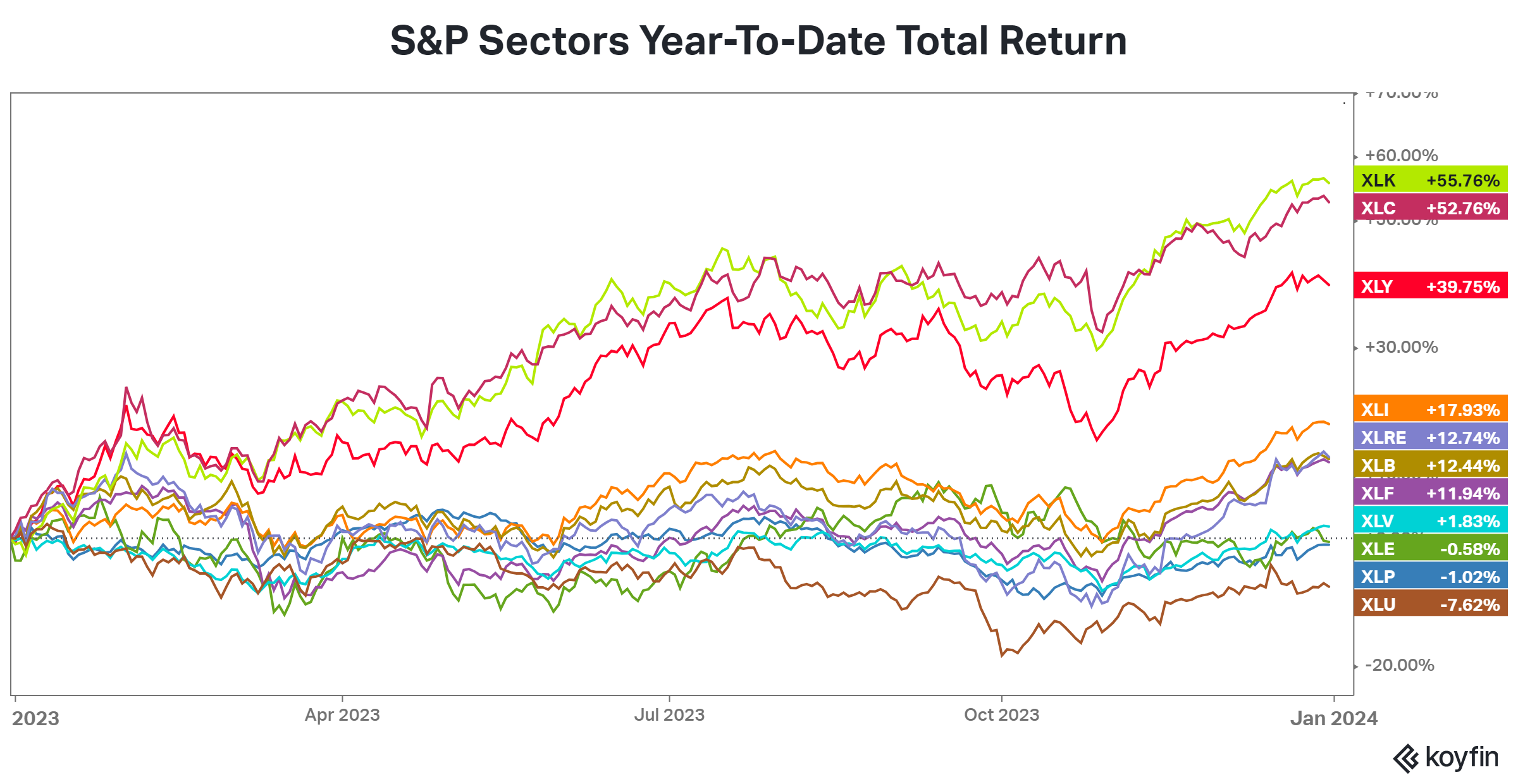

As for the stock market’s sector performance, well, it was a mirror image of last year’s. The most beaten-down (aggressive) sectors, like technology and consumer discretionary, roared back. Meanwhile, defensive sectors, like consumer staples and utilities, failed to keep pace. Energy was also a laggard after posting solid gains in prior years.

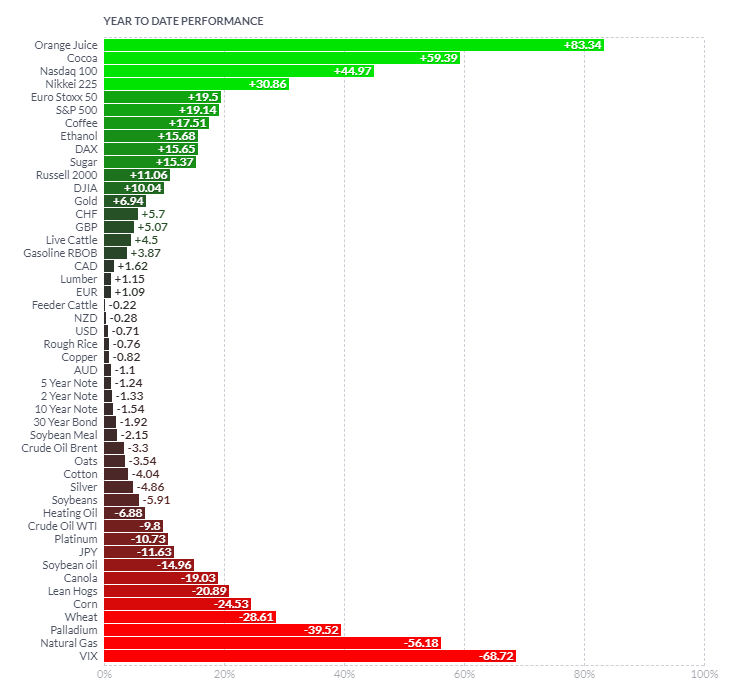

Finally, there were several surprises at the asset class level. Soft commodities like orange juice and cocoa were propelled higher by weather issues, while foreign stocks like Japan’s Nikkei 225 and Europe’s Euro Stoxx 50 posted stronger gains than most U.S. indexes. The overall message was that fear left the building as stocks returned to glory. 👍

Despite the strong rebound, it was still a challenging environment for many investors and traders. If you had a great year, take some time to celebrate your success. And if you had a bad year, remember that nobody gets it right all the time…even if they pretend to. Everyone’s on their own unique journey in the markets, so keep doing you. 🫡

Enjoy the three-day break, and make sure to reflect on 2023 and plan for the year ahead. We don’t know what 2024 will bring, but it’s bound to be an exciting year either way. 📝

Catch you back on the streams this Tuesday. 😉