Almost as if we had taken a time machine back two years, AMC, Gamestop, and Bed Bath & Beyond popped back up in the news today. But not for great reasons. 🙃

First, we’ll start with AMC Entertainment. Last week, the company completed three efforts to pave the way for issuing new shares of stock: a 10-for-1 reverse split, converting $APE units into $AMC shares, and paying out a shareholder lawsuit settlement. And it’s wasting no time getting started.

Just three weeks after getting court approvals to complete all of those actions, the company filed a new prospectus to sell up to 40 million shares of common stock. 💰

The filing said the proceeds will be used to improve liquidity and refinance and repay loans. With $9.5 billion of debt and lease obligations and business operations that are still below pre-pandemic levels, the company has little choice but to raise funds by diluting shareholders further. 🤷

Given investors have experienced significant losses investing in the company, its filing cautioned them against buying new shares. Bolded font in the risk factors section states, “…Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.” ⚠️

Although largely expected, the news still sent $AMC shares down sharply on the day. Shares closed down 37% at new all-time lows. 📉

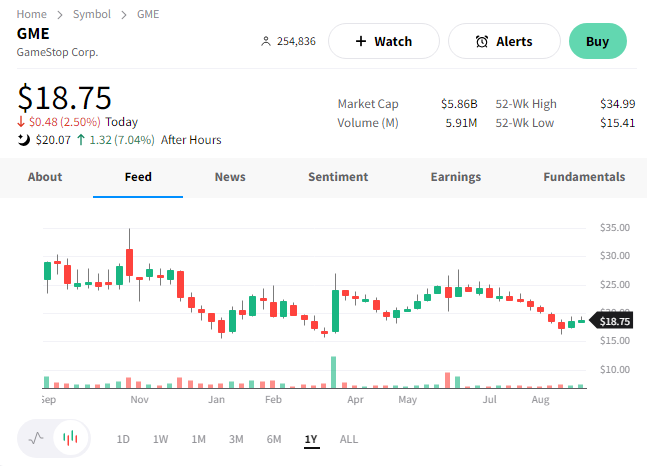

Meanwhile, GameStop experienced a wild after-hours session following its second-quarter results. An adjusted loss per share of $0.03 and revenue of $1.16 billion topped the $0.14 loss on $1.14 billion in revenues expected. 🎮

Driving the strength was a “significant software release” that helped drive software and collectible sales to 49% of total revenue during the quarter. However, the company didn’t provide any additional color on that and did not hold a conference call.

While investors are happy to see sales stabilizing and costs continuing to come down, questions remain about the company’s ability to drive sales growth. It can only cut costs so far, so eventually, it will need to grow sales to deliver earnings growth. But, its shift towards a more online model has been slow, with many leadership transitions in the process. 🐌

After an initial pop of 12%, $GME shares are up 7% after hours as investors process the news. 📈

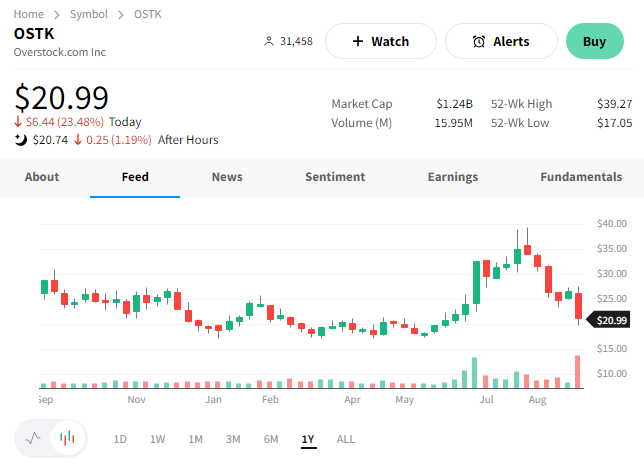

And Overstock.com’s attempt to revive the online portion of Bed Bath & Beyond’s business is off to a rough start. 😬

The company said sales have seen a mid-teen percentage YoY decline so far in Q3. That also includes a low double-digit percentage decline since its new website launched on August 1st. However, executives remain optimistic and say the company’s top-line performance is improving steadily.

$OSTK shares fell 24% on the news as investors remain wary of the longer-term strategy. 😰