After a roughly ten-day cable blackout, Charter Communications and Disney put aside their differences to bring football back to fifteen million households nationwide. 🏈

The deal’s terms can be summarized as:

- Charter will pay Disney higher rates to carry its TV channels

- Ad-supported Disney+ will be available to Spectrum TV select subscribers

- Ad-supported ESPN+ will be available to Spectrum pay-TV subscribers

- Charter pay-TV subscribers will also receive Disney’s direct-co-consumer (DTC) ESPN version

The central sticking point was around the streaming services, which Charter wanted to be included and Disney did not. This appears to be a happy medium as the available ad-supported versions will still allow Disney to monetize the new “free users” acquired from Charter. 🤝

However, based on comments from both companies, it appears Charter got the better end of the deal. 🤔

Charter CEO Chris Winfrey said, “The deal sets the framework for what should be developed throughout the entire industry…” and “Disney’s willingness to meet Charter halfway gives the entertainment giant an opportunity to transform the video business model.”

Meanwhile, Disney Entertainment’s co-chairman Dana Walden said, “We are prepared to make trade-offs to focus on those priorities…” when referring to the new price terms for its TV channels and a boost in distribution for its streaming services.

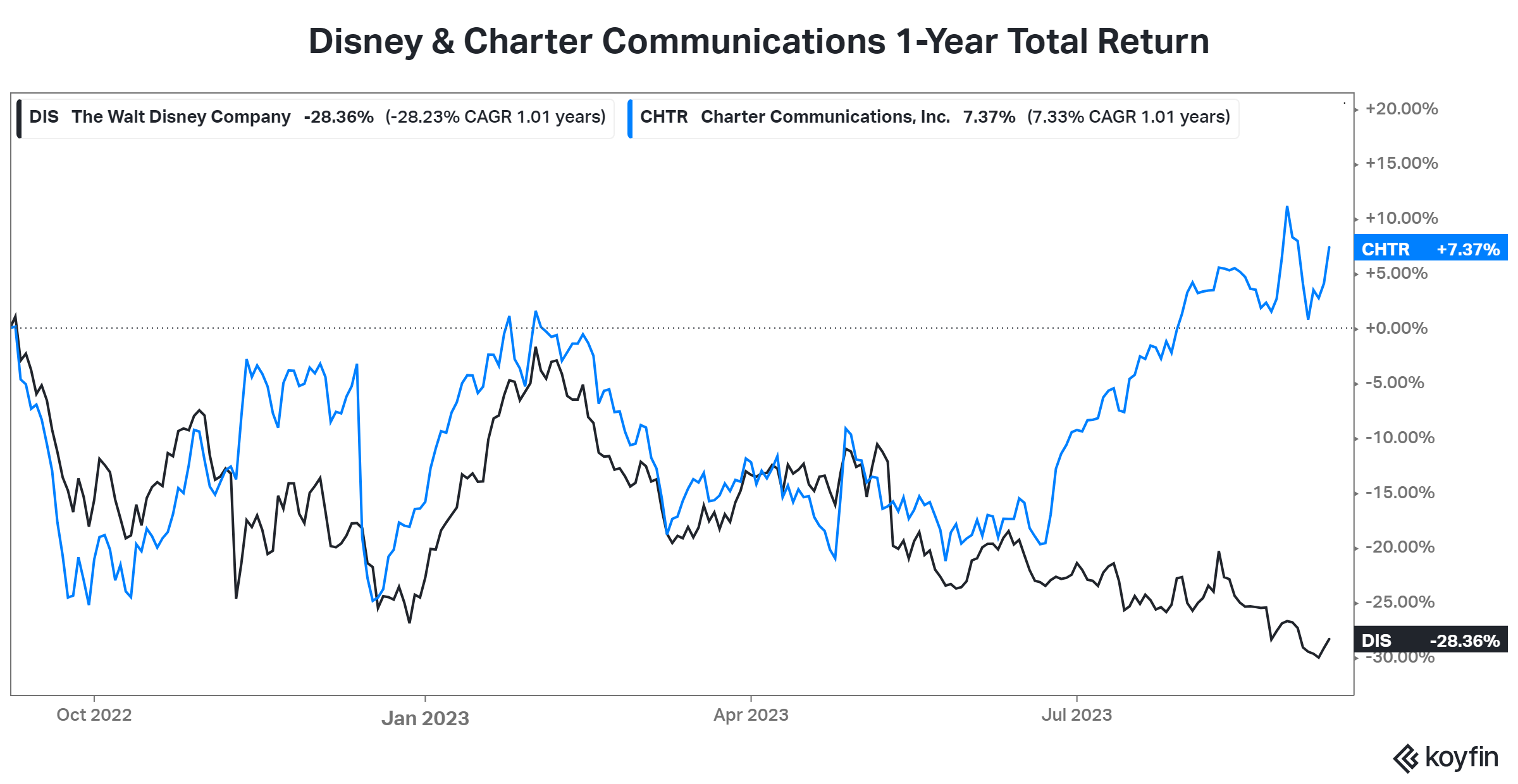

And the market seems to agree with that sentiment for now. Although both stocks were up on the day, $CHTR shares gained about 3x more than $DIS, which continues to sit near nine-year lows. 📊

For now, it looks like Disney and other media players who paid up for NFL and other sports rights don’t have as much leverage over the traditional cable providers as they thought. At least not yet. 🤷