Big-box retailer Target continued its precipitous decline today after becoming the latest company to close some stores due to violence and theft. ❌

The company said it will close nine of its nearly 2,000 U.S. stores after struggling to control crime and safety at those locations. The impacted cities include New York City, Seattle, San Francisco, and Portland.

In a news release, it said, “We cannot continue operating these stores because theft and organized retail crime are threatening the safety of our team and guests and contributing to unsustainable business performance.” Interestingly, unlike other retailers who have closed stores, Target explicitly called out retail crime as its primary reason for the decision. 🚨

During its second-quarter earnings in mid-May, CEO Brian Cornell said organized retail crime had risen in its stores and that overall shrink would impact full-year profitability by more than $500 million. He also reiterated back then that the company did not want to close stores. But evidently, the problem has become bad enough to close at least these nine stores and likely review others.

Overall, theft is just one of the company’s recent headwinds. Over the last year, it’s faced an inventory glut, backlash over its Pride merchandise, and a continued pullback in consumer spending on discretionary items. But beginning last August, it started calling out shrink as a significant factor in its margins and has continued to do so. 😬

However, some analysts and industry experts remain wary of claims that the impact of theft on retailers has been worse than in recent history. A National Retail Federation study showed that the effect of theft on retailers’ bottom lines is largely in line with what it has been in past years. Thought it could just be it’s impacting certain retailers more than others. 🤔

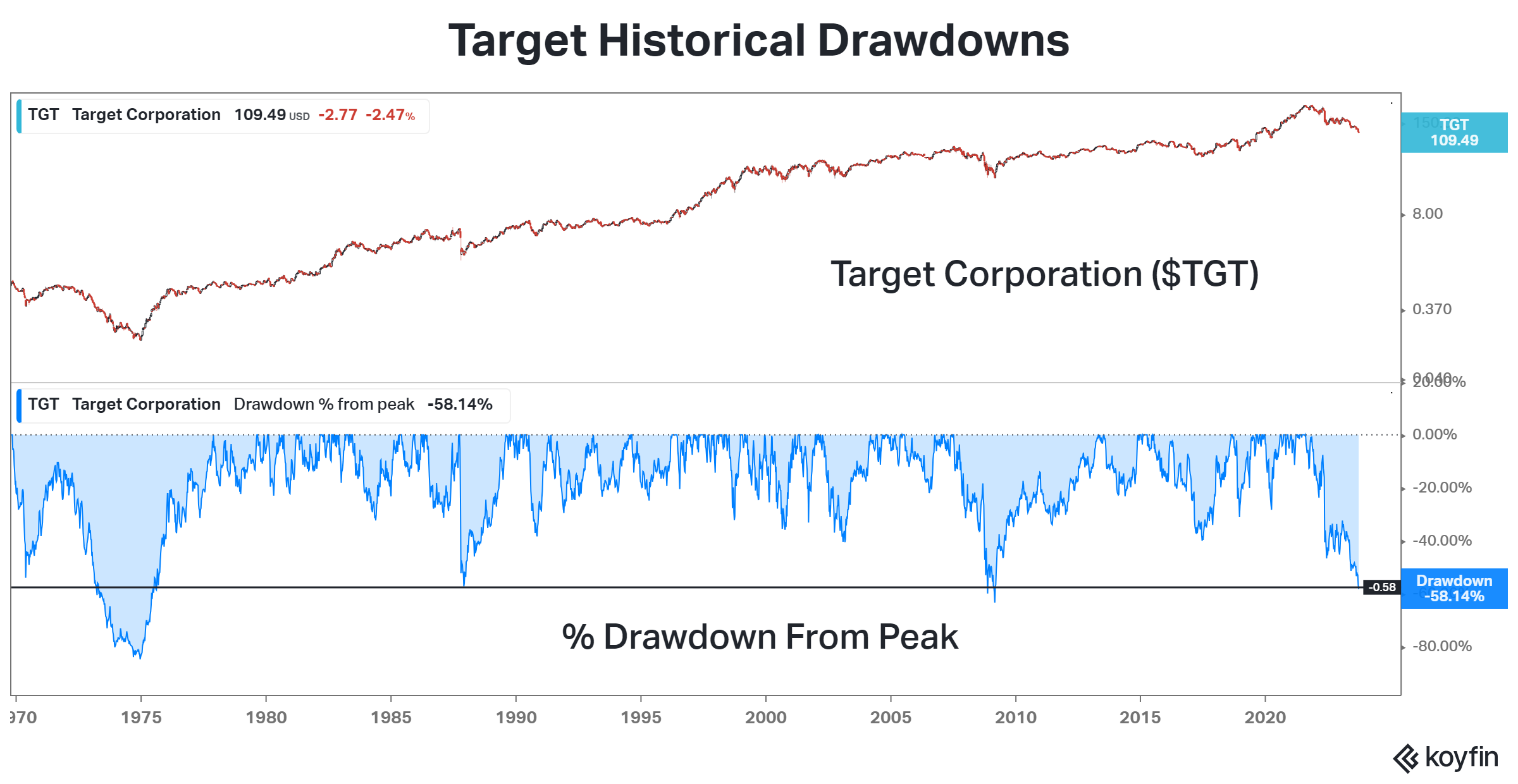

Whether or not it’s a “valid reason” or not, something is undoubtedly hitting Target’s stock. $TGT shares are now down nearly 60% from their all-time highs, marking their fourth largest drawdown as a public company.

As of now, it’s unclear what the catalyst will be to turn the company’s current trajectory around. With most companies offering a cautious consumer outlook, it’s unlikely to be a blockbuster holiday shopping season for the retailer and its peers. But as always, time will tell. 🤷