The market had been pricing in some aggressive rate cut expectations for 2024, looking for as many as six cuts from the Federal Reserve. However, with last month’s employment data coming in pretty strong, there is a lot of riding on the first month or two of data this year. 📝

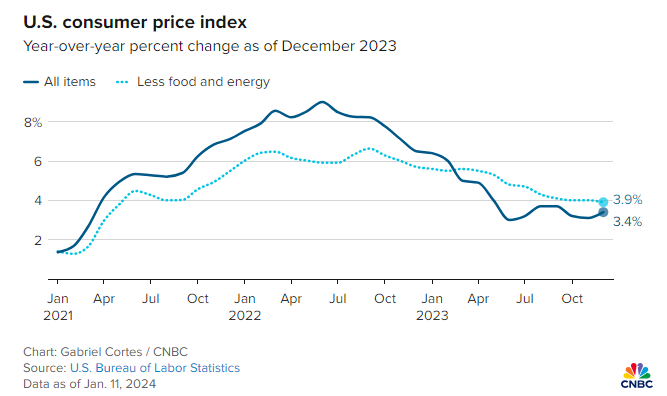

Unfortunately for stock market bulls and rate-cut enthusiasts, today’s consumer price index (CPI) data did not help their case.

December’s headline CPI rose 0.3% MoM and 3.4% YoY, higher than estimates of 0.2% and 3.2%. Excluding food and energy prices, core CI rose 0.3% MoM and 3.9% YoY. That was mixed vs. estimates of 0.3% and 3.8%. 🔺

The positive sign for bulls is that a substantial portion of the increase once again came from shelter costs, which have been a sticky component. This month, they rose 0.5% MoM and accounted for over half the increase in core CPI. On an annual basis, they rose 6.2%, representing about two-thirds of core CPI’s YoY increase. 🏘️

Analysts continue to point out that the CPI calculation for shelter costs lags real-time costs significantly, so the reported rate may be overstated. We’ve already seen builders lowering average selling prices for homes, and rents are falling in several areas across the country so that reported number should start to come down. The question remains when.

Bearish analysts acknowledge the shelter component may be a bit exaggerated; however, they point to other components like medical services and motor vehicle insurance that are placing upward pressure on inflation. Their overall point is that inflation still has sticky parts, especially in services.

They also point to the Red Sea crisis as another potential headwind for further disinflation. ⚠️

Short-term shipping rates have spiked due to attacks in the Red Sea disrupting the global trade route that accounts for roughly 30% of traffic. Shipping giant Maersk warned that operations could take months to return to normal, forcing ships to take the much longer journey around Africa to reach their destinations, raising fuel consumption and shipping times. 🚢

Weekly jobless claims also fell again last week, showing continued strength in the job market.

Between the sticky inflation factors, geopolitical/global trade risks, and a strong employment market in the U.S., it’s unlikely that the Fed will feel comfortable cutting rates in the first quarter. They’ve consistently said they do not want to underestimate inflation’s ability to roar back and will not adjust until they’re sure the 2% inflation target is within reach.

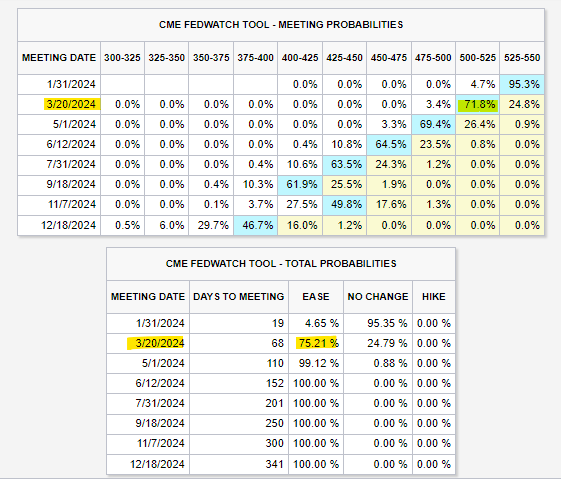

The bond market still isn’t on the same page. With it still pricing in a roughly 75% chance of a March cut, we’ll have to see how its game of chicken against the Fed ends. 🐔