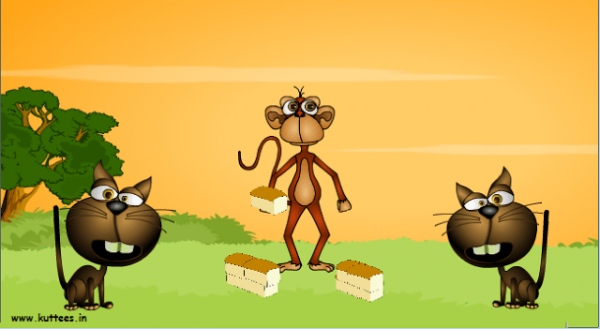

Once upon a time, two cats found a loaf of bread, and they started fighting over who would eat it.

A monkey was passing by when it overheard conversations and said, “Let me share the bread among you both.”

… And at the end, the monkey ate the whole loaf of bread, leaving the cats stunned.

Moral of the story: Whenever you fight, someone else wins.

Are you familiar with the story of ‘The two cats and the monkey’? The tale might be an allegory for what’s going down inEastern Europe. The two fighting cats are Russia and Ukraine, and the ultimate winner is the monkey – crypto. In the Russia-Ukraine war, crypto is helping both sides and is ultimately winning.

Let’s begin with Ukraine, which is receiving global support and has raised $42 million in cryptocurrency donations to fund its war effort. Currently, the government allows people to donate using Bitcoin, Ethereum, Dogecoin, and Polkadot. Not only this but Uniswap, the largest decentralized exchange, has entered the war by allowing investors to fund it on its platform.

However, Ukrainian and Russian citizens are playing the other side of the ball – Bitcoin is currently selling at a premium against the Ukrainian Hryvnia because of the suspension of electronic cash transfers and the prohibition on Ukrainian citizens withdrawing foreign currency. And on the enemy front, Russia has also limited withdrawals to foreign currencies as the Russian Ruble fell to a record low against the dollar earlier this week.

While the country is piling up cryptocurrencies, it doesn’t want crypto exchanges to support the Russian Ruble and has requested major exchanges to stop supporting it. However, the crypto exchanges aren’t in the mood to ban Russian account holders. Binance, the largest crypto exchange, has made it clear it will not ban Russians, citing it as ‘unethical behavior.’

“It’s not our decision to make to freeze user accounts. Facebook hasn’t banned Russian users. Google has not blocked off Russia. The U.S. hasn’t done that,” said CEO Changpeng ‘CZ’ Zhao in an interview with Bloomberg.

“Also, on an ethical point of view, many Russians don’t support the war, so we should separate the politicians from the normal people.”

Many analysts believe that after receiving hard sanctions from the world, Russia will once again focus on cryptocurrency – which is unregulated. The country is already working on its digital Ruble and could use it to trade with other countries interested in the business. Iran and North Korea, for example, have both used digital currencies to evade international sanctions somewhat.

It’s strange how crypto is playing a large role in defining the shape of Eastern Europe. Otherwise, no one would have imagined it back in 2009 when Bitcoin was born that it would serve both attacker and victim in a war one day.