FTX

FTX ($FTT.X) continues to behave as the savior of the distressed crypto market. Liquid Global, a recently hacked exchange, lost upwards of $90 million in the hack. FTX issued a $120 million loan to shore up Liquid Global’s capital position, provide liquidity, and speed up capital projects.

FTX is also partnering with Busan City, the ‘Blockchain capital’ of South Korea, to build a local crypto exchange. Busan has a similar partnership with Binance ($BNB.X).

And this is interesting: some recently released visitor logs from the White House show that Sam Bankman-Fried, FTX’s Director of Government Relations and Policy, and FTX’s Head of Policy (former CFTC commissioner Marke Wetjen) visited with President Biden’s head of policy in May 2022.

No details of the meeting were disclosed.

Crypto.com

Ever asked for a refund from a company and received a little more back than you were owed? That happened to a woman in Australia. She asked Crypto.com ($CRO.X) for an AU$100 refund and instead got nearly AU$10.5 million (US$7.15 million).

How long did it take for Crypto.com to realize its mistake? Nearly seven months. During that time, the woman bought a million-dollar home, sent AU$430,000 to her daughter, and made various other major purchases.

The exchange is taking her to court to recover the money. Which is kind of funny if you think about it. When you send your crypto to the wrong wallet, exchanges shrug their shoulders and say, ‘sorry bra, your SOL.’ When the exchange makes an oops, they want to throw the cops after you.

Ya, it’s two different things, but you probably get the point.

Coinbase

#CardanoCommunity waiting for @coinbase to start upgrading for the #VasilHardFork ⌛⏲😉#Cardano pic.twitter.com/pbhMeBMWgh

— P₳ul 🇮🇪 (@cwpaulm) August 30, 2022

Ethereum’s ($ETH.X) ‘Merge’ is ready to go on Coinbase ($COIN), but interestingly, the same can’t be said for Cardano’s ($ADA.X) upcoming Vasil hardfork. This is a little odd given that Cardano is the fourth largest traded crypto by volume, behind Bitcoin ($BTC.X), Ethereum, and Solana ($SOL.X). ADA hodlers on Coinbase could be stuck moving their ADA if Coinbase isn’t ready in time.

Voyager

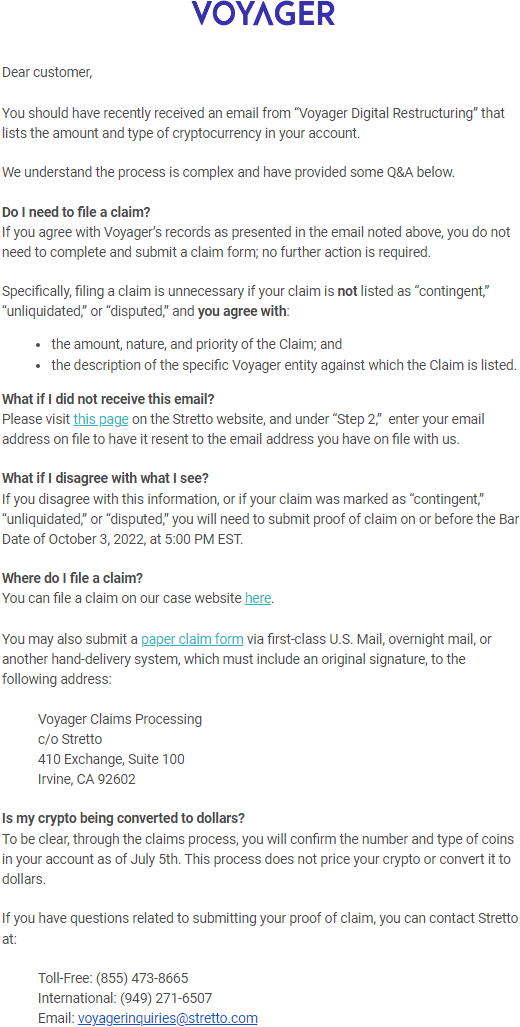

Voyager ($VGX.X) hasn’t been a major topic of discussion lately, mostly due to the pause in info from the bankruptcy proceedings. However, Voyager did recently send out e-mails to customers this afternoon. The e-mail is titled Claims Process Q&A.

Link to the Stretto Voyager FAQ

Link to Claim Filing Process and Q&A

As information becomes more clear, we’ll update you. 📰