The Ark Innovation ETF, $ARKK, had its best performing month ever in January – with a lot of its performance likely due to its $COIN holdings. 💯

How well did ARKK do in January? +28.82% good.

During an interview with Yahoo! Finance, Wood was asked whether the market is witnessing a bear market rally or if things have changed.

She said, “… effectively the bond market is saying we don’t have an inflation problem, and the Fed is probably close to the end of this move. Last year, we did have, as you call them, bear market rallies, and they were pretty powerful…”

Wood continued, saying that Fed Chair Powell ended the rallies by repeating the Fed’s belief that inflation is not under control and hikes would continue at 75 bps. ⬆️

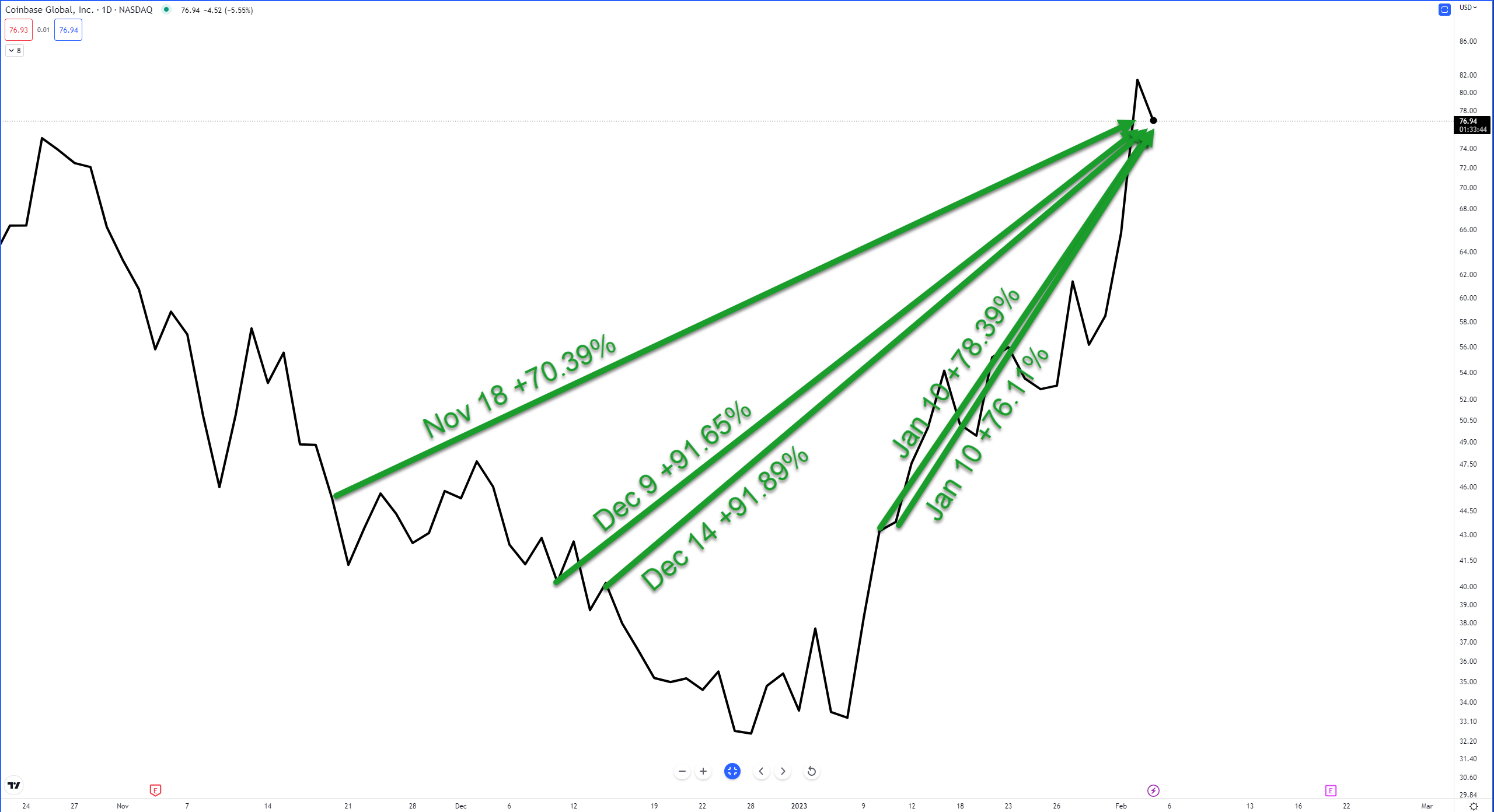

Bear market or bull market, how have the Coinbase purchases performed? Let’s look:

Pretty damn well.

But Wood isn’t the only big player in the crypto space. $MSTR‘s Executive Chairman, Michael Saylor, remains an ardent Bitcoin bull.

MicroStrategy reported earnings yesterday and posted an impairment charge of $197-ish million due to its $BTC.X holdings.

It doesn’t sound pleasant, but Q4 started with Bitcoin near $19,000 and ended near $16,500. Bitcoin is currently trading at around $23,300 at the time of writing.

Saylor and MicroStrategy CFO Andrew Kang repeated that the company would continue to acquire, hold and grow its Bitcoin position during the earnings call

Saylor reiterated during the call that MSTR continues to outperform the major indices and tech companies like $AAPL, $MSFT, and $GOOG. 🤯