We don’t typically touch on crypto news, but several events from today were worth noting. 📰

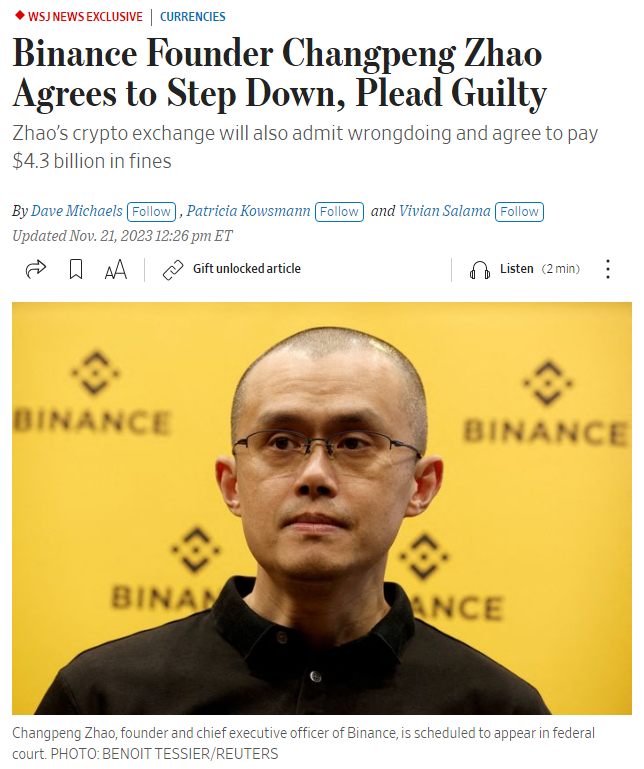

The first significant development is that Binance’s Changpeng Zhao is reportedly sacrificing himself to save the company. The Wall Street Journal indicated that the founder and CEO plans to step down and plead guilty to violating criminal U.S. anti-money-laundering laws. Binance will also plead guilty to a criminal charge and pay $4.3b in fines to settle civil allegations.

The deal would end long-running investigations into Binance but also allow Zhao to retain his majority ownership in the world’s largest cryptocurrency exchange. Additionally, Binance would be placed under federal monitor supervision to oversee its exit from U.S. markets.

It is important to note this potential settlement wouldn’t resolve its issues with the U.S. SEC, which sued both parties for allegedly violating U.S. investor-protection laws. However, it did resolve a lawsuit by the Commodity Futures Trading Commission (CFTC) earlier this year, alleging Binance and Zhao deliberately circumvented regulations to allow U.S. customers to use its services.

Meanwhile, the U.S. crypto exchange Kraken is the latest Securities and Exchange Commission (SEC) target. The regulator has accused it of operating an unregistered platform and improperly commingling customer funds with its own corporate assets. The suit’s claims are similar to those the SEC has targeted Binance and Coinbase with as it looks to shut the exchanges down. 🦑

The news put pressure on Binance Coin as crypto investors assess what the deal means for the exchange’s (and industry’s) future. ₿