Market Cap: $941 million

YTD: 135.14%.

Project Focus: SingularityNET ($AGIX) is a decentralized marketplace for AI services, designed to allow anyone to create, share, and monetize AI services at scale. The platform aims to be the core protocol for networking AI and machine learning tools to form a coordinated Artificial General Intelligence (AGI) with capabilities that exceed the sum of its parts. In other words, Skynet. I think.

What Makes It Unique: The uniqueness of SingularityNET lies in its vision to democratize access to AI technology, enabling developers, companies, and individuals to collaborate and access AI services easily. It promotes an open-source and decentralized approach to AI development, fostering innovation and reducing monopolistic control over AI technologies. Also, it’s built on Cardano’s ($ADA) blockchain.

Of the five AI plays we’re looking at in today’s Litepaper, AGIX is by far the best performer YTD.

From a technical perspective, the conditions are relatively the same as for Render. The only exception is the current daily candlestick, which is not as bearish as Renders, but still ugly for bulls.

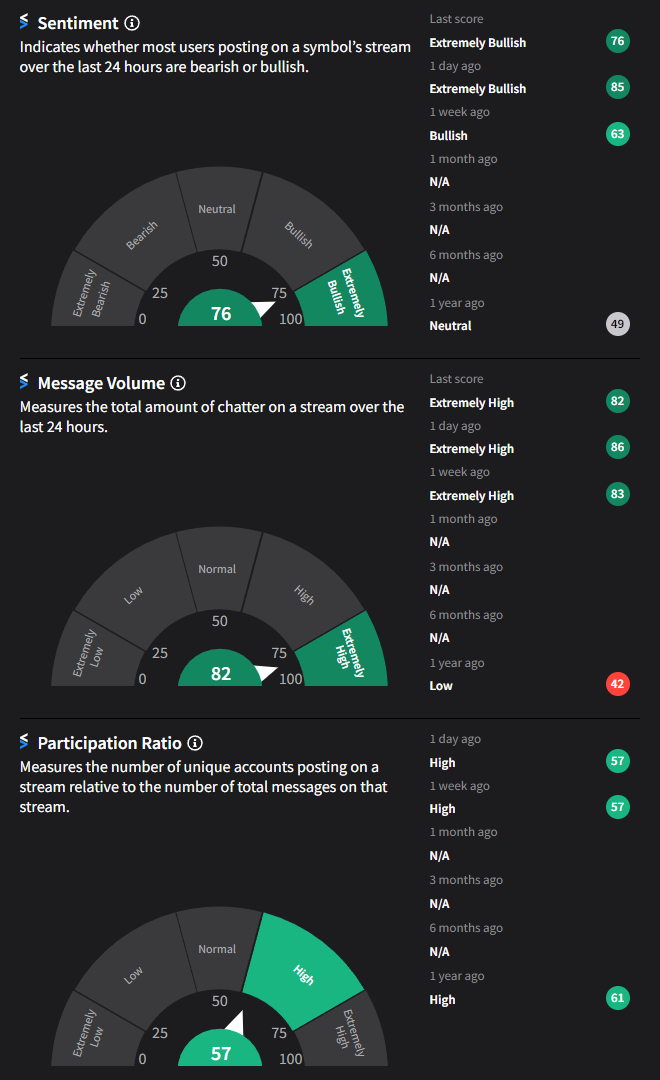

Stocktwits Sentiment Data for SingularityNET