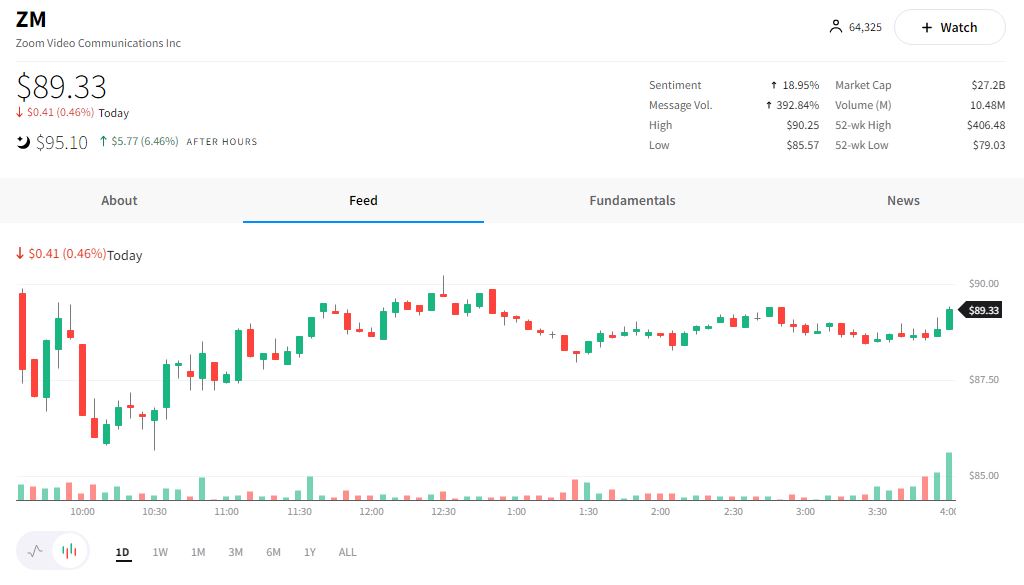

Zoom is popping after the company reported better-than-expected earnings and strong guidance.

The company’s adjusted earnings per share beat the $0.87 expected by analysts, coming in at $1.03. Revenues met expectations at $1.07 billion. 📈

The company now expects full fiscal year revenues of $4.53 – $4.55 billion versus $4.55 billion expected. More importantly, it now expects to earn $3.70 – $3.77 per share, significantly above analyst expectations of $3.53 per share. 🎯

After five straight quarters of triple-digit revenue growth during the pandemic, investors were worried that Zoom would be unable to reduce costs as growth decelerates.

Today’s results and updated guidance suggest that the company may be on the right path.

With the stock down 85% from its all-time high set during the pandemic, investors are cheering any positive news, with shares up as much as 16% after hours. 👍

Gains are slowly fading, so we’ll have to see how investors ultimately digest today’s news.