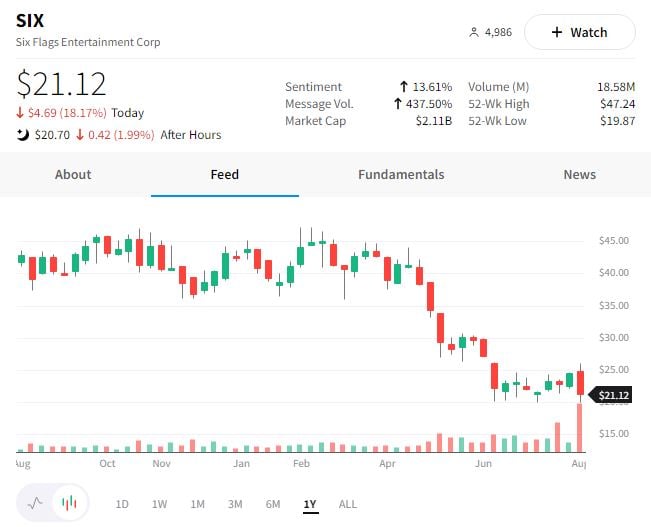

Six Flags Entertainment investors were not entertained by the company’s lower-than-expected earnings and revenue. 👎

The company cited weaker traffic as the primary driver, telling investors that attendance fell by 22% YoY. They also subtly blamed Jesus for the weak traffic numbers, noting that Easter was later this year and that spring break was weaker than expected. 😂

The poor results sent its shares on a rollercoaster today, down nearly 20%. 🎢

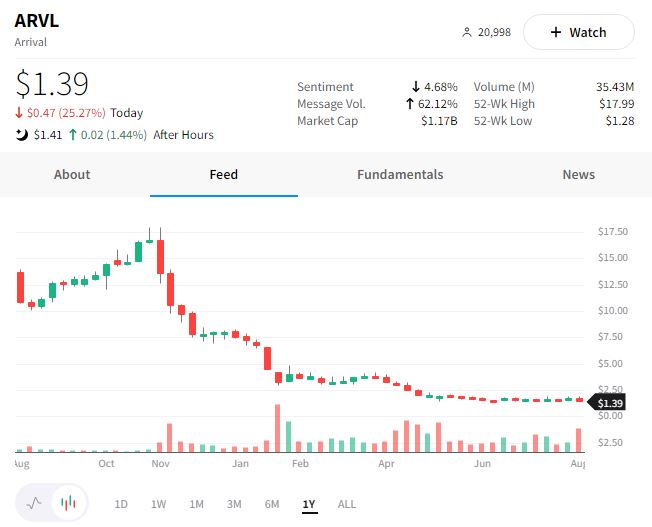

Arrival’s earnings arrived today…and investors are “returning to sender,” shipping the stock down 25%. 📉

The electric vehicle startup expects to begin production of the highly-anticipated EV van this quarter but does not expect any revenue this year. It posted a $90 million loss this quarter, up from $56.2 million last year, as it increased expenses to ramp up production.

The company established a $300 million At The Market (ATM) platform, which will allow it to raise funds by selling stock. It projects that this program will fund the business through at least 2023 without having to raise more capital. 💰

For now, it seems investors are struggling to share in that vision…instead seeing a lot of expenses and no product. As with many electric vehicle startups, they remain guilty until they prove they can meet their projections. 🤷♂️

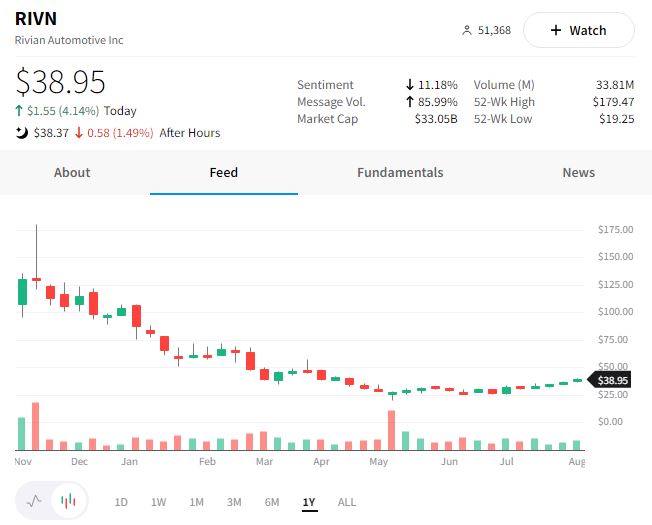

Electric vehicle maker Rivian also reported today, with revenue and earnings beating estimates. 👍

The company maintained its full-year guidance for deliveries but trimmed its full-year financial outlook. As a result, it’s now telling investors to expect a wider loss and lower CAPEX than previously forecasted.

It pointed to a delayed production ramp, higher raw materials and freight costs, and continuing supply-chain challenges as the reasons for its updated guidance.

So far, investors don’t appear too concerned about the news, as shares are only down marginally after hours. 🔻

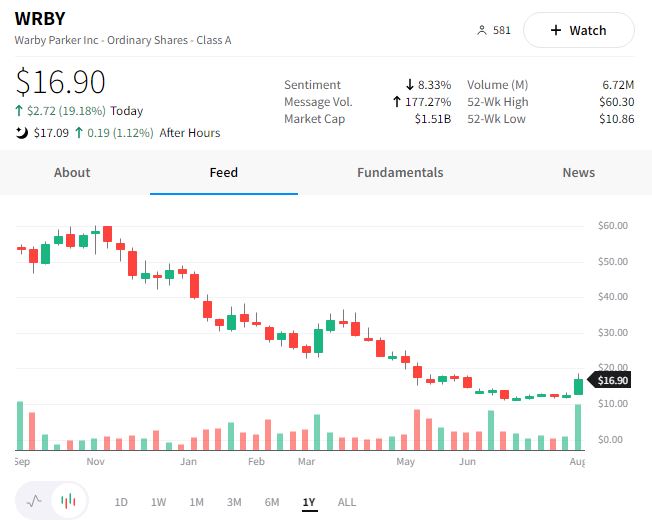

Warby Parker joined other retailers in slashing its full-year sales outlook, blaming a weaker macroeconomic environment.

Despite the weak forecasted, its current quarter loss per share and revenue slightly beat Wall Street expectations. Its count of active customers increased 8.7% to 2.26 million, and sales grew 14% YoY, boosted by loyal customers spending more. 👍

The company remains in expansion mode but is being strategic about how it spends, given the tougher environment.

In the face of this mixed news, the stock rallied nearly 20%. The confusing action marks another instance where maybe expectations got too low, allowing the company to simply step over the bar. 🤷♂️

Veru shares continued their volatility today, rocketing higher by 36% despite missing estimates of its earnings and revenue numbers. 🔺

The company reiterated that it’s focused on scaling the manufacturing of Sabizabulin in preparation for potential emergency-use approval in the U.S. and parts of Europe.

As we typically see with biotech companies, many investors expect continued volatility until it receives a ruling on its drug from the various governing bodies. 📝