Palo Alto Networks is getting pounded by sellers after hours, dragging the rest of the sector down with it. Let’s see what happened. 👇

The cybersecurity giant reported adjusted earnings per share of $1.46 on revenues of $1.98 billion. Unfortunately, that’s where the good news ended.

The company said it saw its ten highest-spending customers raise their spending by 36% YoY, but they’re beginning to see fatigue in cybersecurity budgets. The trend started late in the first quarter and continued into the second, with it expected to impact the next two quarters well. Its reliance on U.S. Federal government spending during an election year is proving difficult. 💸

As a result, management now expects full-year total billings of $10.10 to $10.20 billion, down from its previous guide of $10.70 to $10.80 billion. That means its full-year revenue range was also adjusted downward from $8.15 to $8.20 billion to $7.95 to $8.00 billion.

CEO Nikesh Arora said the guidance cut represents a “shift” in strategy, “wanting to accelerate growth, our platform migration, and consolidation and activating AI leadership.” There are a lot of buzzwords there, but not enough to keep shareholders on board, especially as management says they expect a “difficult customer” in the near term. ⚠️

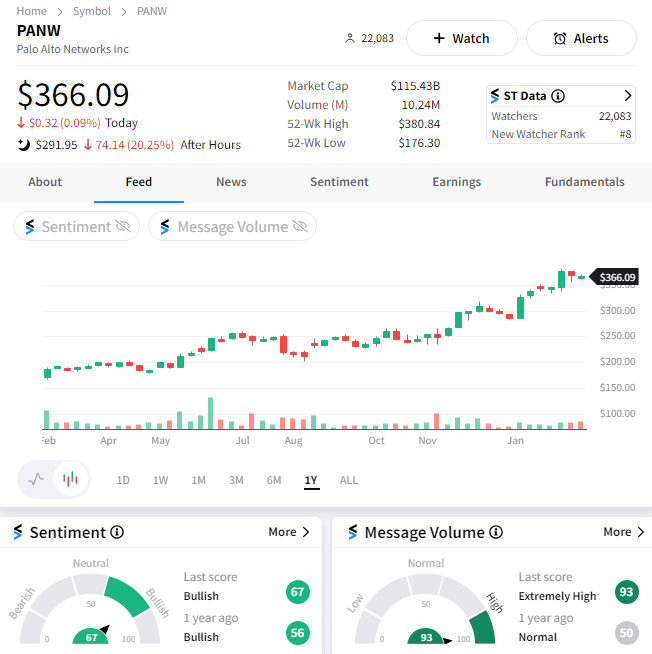

Who knew it could be so challenging to make money in cybersecurity when there’s a hack or data breach seemingly every day? Nonetheless, investors were not happy with what they heard and sent $PANW shares plummeting 20% after the bell. 📉

With the stock pulling back from all-time highs and still in a long-term uptrend, it’ll be interesting to see how eager the bulls are to “buy the dip” in this industry leader. As always, time will tell. 🤷