If it seems like we’re talking about a retailer lowering forward guidance almost daily, it’s because we pretty much are. 🤪

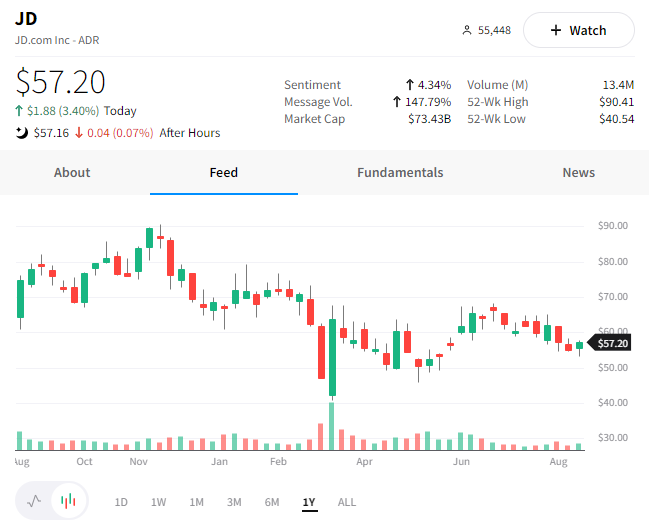

Today we heard from luxury department store Nordstrom, which beat earnings and revenue expectations this quarter.

On the positive side, the company’s digital sales rose 6.3% YoY, comprising 38% of its total revenue. Nordstrom Banner grew 14.7%, with the strongest growth coming from its men’s apparel division. 👍

On the negative side, its Nordstrom Rack offering for lower-income consumers grew just 6.3% YoY and remains below pre-pandemic levels. Additionally, customer traffic and demand decelerated significantly in late June, which is forcing the company to cut its full-year financial forecast. 👎

Overall, investors were not thrilled with the news, sending the stock down nearly 14% after hours. 🔻

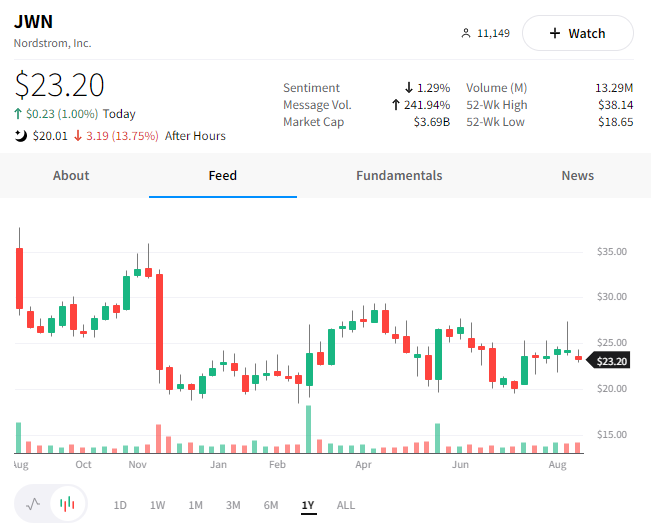

Macy’s sang a very similar tune, beating expectations this quarter before cutting its full-year financial forecast. ✂️

The retailer expects a further decline in consumer spending on discretionary items like apparel, similar to comments we’ve heard from Walmart and Target.

Despite the negative news, the stock rallied nearly 4% today. 🤔

Either the market already priced this news into the beaten-down stock, or investors are starting to believe the company’s Polaris turnaround plans, which involve opening smaller-format stores and investing in its digital operations. Guess we’ll have to wait and see. 👀

The overall theme from retailers’ earnings is that consumer is not as healthy as they were in prior quarters. 🤒

The lower and middle-income consumers are being hit hardest by inflation, causing them to reduce their spending on discretionary items and buy more lower-margin essential goods. The higher-income consumer is also showing cracks, though not nearly as many. 🛒

And from the number of companies reducing their forward guidance, it doesn’t sound like they expect an improvement through the end of the year. Most of them are using the downturn to clean up their houses and adjust their business models to address the industry’s structural issues (e-commerce, changing consumer behavior/demands, etc.).

The one hope for the stocks may be that expectations are pretty low. We’ll have to see if they’re low enough for them to beat in the coming quarters. 🤷♂️

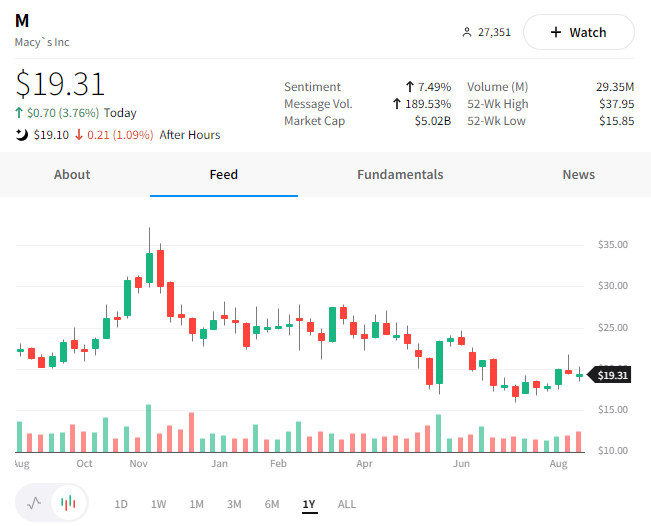

Lastly, we’re moving from traditional retail to Chinese e-commerce giant JD.com.

Just a week after Tencent posted its first-ever revenue decline, JD’s reported its slowest quarterly revenue growth ever at 5.4%.

With that said, the company beat revenue and earnings expectations despite a challenging macroeconomic environment exacerbated by the country’s covid lockdowns. 💪

Overall, the messaging was similar to other high-flying tech and e-commerce companies. A focus on profitability and cost discipline has become commonplace as revenue growth has slowed or, in some cases, declined.

The stock closed up 3.40% as investors digested the news. 📈