When people hear the word “general,” they may think of the military, car insurance, or automobiles. However, today we’re talking about a general in the food space whose stock price has quietly moved to all-time highs.

That stock is General Mills, which marched higher today after reporting better-than-expected earnings and raising its forecast. 💪

The $47 billion consumer foods company known for Cheerios, Betty Crocker, and Häagen-Dazs reported adjusted earnings of $1.11 and revenues of $4.72 billion. Earnings beat expectations by $0.11 per share, while revenue matched estimates.

Given the U.S. dollar’s strength, multinational companies have struggled internationally, and General Mills was not exempt. Its international sales dropped 30% YoY. 😮

Offsetting that weakness was strength in its North American Retail, North American Foodservice, and Pet sales, which saw YoY growth of 10%, 21%, and 19%, respectively. The company expects that strength to continue, raising its fiscal 2023 guidance for EPS growth of 2%-5% (from 0%-3%). Additionally, it expects organic net sales to rise 6%-7% vs. previous guidance of 4%-5% YoY.

Whether defensive areas of the market will continue to be a safe haven during these volatile times remains to be seen. But so far, that seems to be the case for companies with good results.

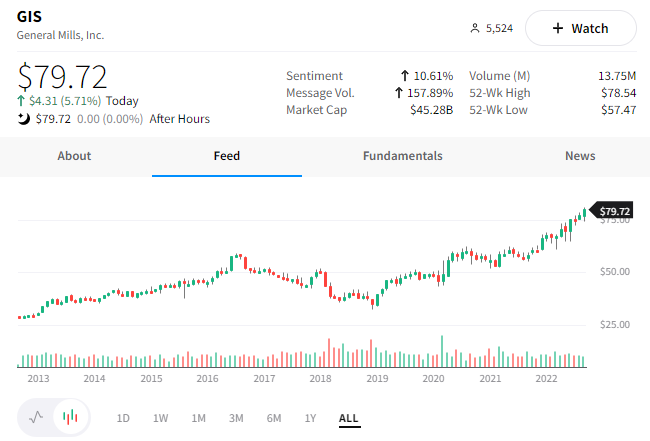

Investors cheered the strength and sent $GIS shares up 5.71% to new all-time highs while the market flopped. 📈