With bellwether companies like FedEx and Target missing earnings, investors can add Nike to their list of disappointments.

On its surface, the athletic apparel company’s report didn’t seem that bad. EPS of $0.93 beat the $0.92 expected, and revenues of $12.69 billion were above estimates of $12.27 billion. 📈

With that said, its forward guidance is what’s getting it put in the dog house. The company says supply chain headwinds like rising shipping costs and times have caused its inventory levels to swell significantly during the quarter. While this was partially offset by strong demand, concerns over its sales channels remain.

The largest part of Nike’s business is wholesale, which only saw a 1% increase. Meanwhile, its direct sales grew by 8%, and its digital-brand sales rose by 16%.

As expected, shutdowns in the Greater China region caused a sales decline of 16%. So although conditions in China are improving, there’s still a lot of uncertainty around its business there. And with the U.S. economy looking like it’s going to get worse before it gets better, some analysts have concerns over demand in North America. 😬

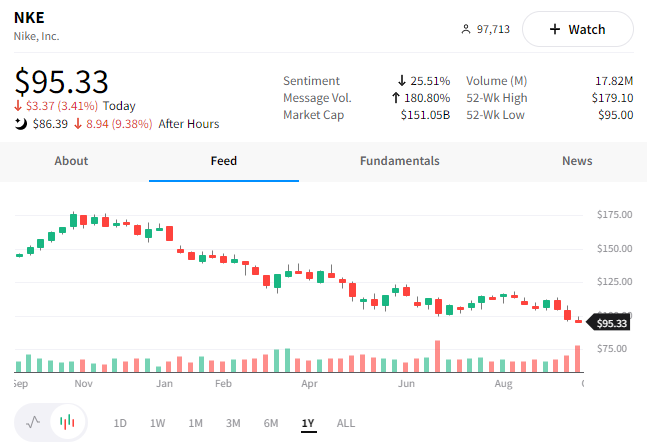

In the short-term, bearish investors are shipping the stock back, sending shares down another 10% after hours. Meanwhile, the bulls argue that the stock is already down more than 50% and that much of the bad news is already baked in.

Given the current market and economic environment, bears feel like they still have the upper hand. However, we’ll have to see what the rest of the week and next quarter bring for $NKE. 🤷