Although mega-cap technology giants like Meta, Alphabet, and Amazon are having no trouble in the advertising market, smaller players like Snap are. That trend continued today, with Pinterest missing revenue estimates. Let’s take a look at the numbers. 👇

The social media company’s adjusted earnings per share of $0.53 topped the expected $0.51. However, revenues of $981 million were $10 million shy of estimates despite rising 12% YoY.

Monthly active users rose 11% YoY to 498 million. That was ahead of the 487 million analysts anticipated, but its global average revenue per user of $2.00 was $0.05 shy of the consensus estimate of $703 million. Its first-quarter revenue guidance implies 15% to 17% YoY growth but came in shy of the consensus estimate of $703 million. 🔺

Shares initially sold off sharply but recovered some losses after CEO Bill Ready announced a “third-party app integration with Google.” This is similar to its partnership with Amazon, and Ready said it should help the platform better monetize non-U.S. markets.

Overall, investors remain concerned about the company’s struggle to monetize its user base. Until it figures out how to make its advertising offering more competitive, it’s stuck preserving earnings through cost cuts and other short-term measures. 👎

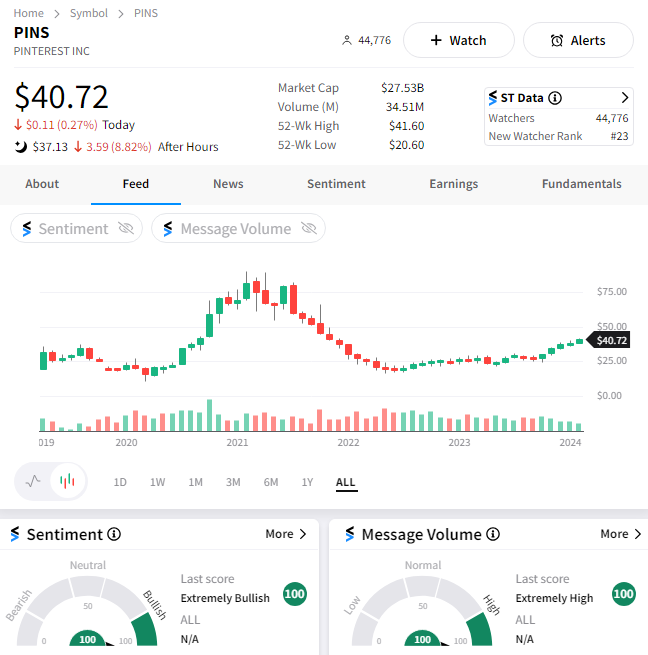

$PINS shares are down about 9% after hours. Despite that, the Stocktwits community is looking on the bright side of things as sentiment sits in “extremely bullish” territory. 🐂