After hearing mixed results from big box retailers Tuesday and Wednesday, several mall retailers presented results that sent shares surging. 😮

Macy’s beat both earnings and revenue expectations. Adjusted earnings per share were $0.52 vs. the $0.19 expected. And revenues of $5.23 billion marginally beat the $5.2 billion expected.

The company trimmed its full-year revenue guidance in August and stood by that today despite the tougher sales backdrop. The company says it has the right inventory mix for the upcoming holiday season and is showing strong luxury sales.

Additionally, its fresher inventory has allowed it to keep its pricing power, leading it to raise its full-year earnings guidance. 🔺

The company’s turnaround plan is still in process, but investors liked what they saw today. $M shares rose 15% to their highest level since June.

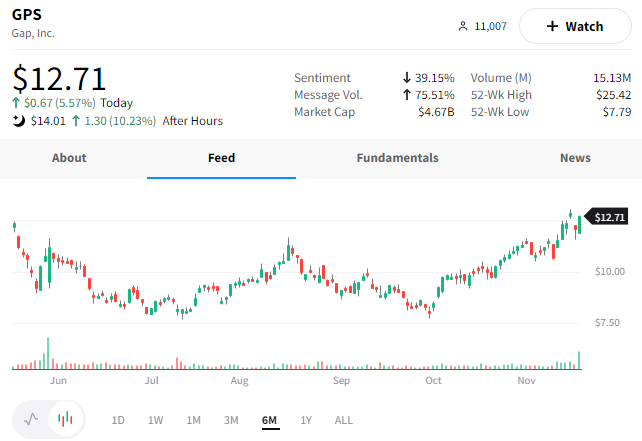

Gap also beat Q3 revenue expectations, coming in at $4.04 billion vs. the $3.8 billion expected. Its adjusted earnings per share of $0.71 showed a dramatic YoY improvement as the company got its inventory and costs under control. 👍

Like Macy’s, the retailer’s luxury brand Banana Republic was the clear standout, with comparable sales rising 10%. Meanwhile, Gap’s namesake brand saw comparable sales rise 4%, while Old Navy was down 1% and Athleta was flat.

Despite the improvements, the company offered a cautious view of the holiday shopping season, saying that its overall net sales could be down mid-single digits YoY in Q4.

Like its peers, the company is amidst a long-term turnaround plan and has more work to do. Today’s progress was enough to send $GPS shares higher by 16%. 📈

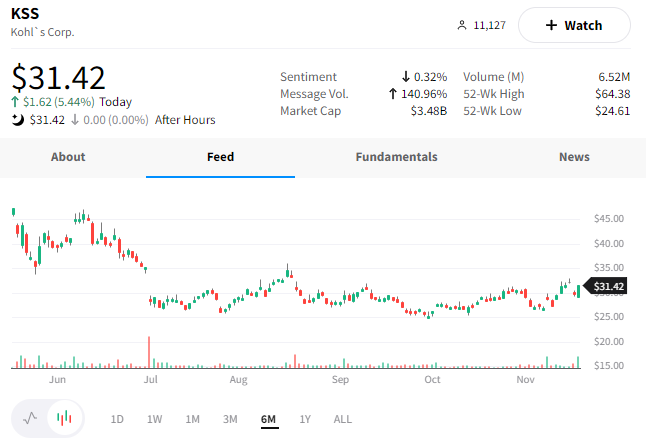

Last up is Kohl’s, which saw results in line with its trimmed guidance earlier in the quarter. 🛍️

Sales fell 7% to $4.28 billion as inflation and the weaker macro environment pressure the company’s core customer base, middle-income consumers. Executives say that segment is buying fewer items and opting for less expensive brands. Though, the coming did see an uptick in sales from its lower-income and higher-income customers.

On that note, the company withdrew its guidance for the year, citing a volatile retail environment and overall economic uncertainty. It says its visibility for the fourth quarter is difficult. However, it expects the holiday shopping season to be highly promotional as shoppers opt to begin purchases later in the quarter than last year.

Additionally, activist investors continue to circle the company. It’s also it looking for a new CEO to replace Michelle Gass, who is departing in December. All while it tries to execute a broader turnaround plan which includes redesigning stores, adding new brands, and offering new e-commerce options. 🏬

Needless to say, the retailer has a lot on its plate. After initially selling off on the news, shares $KSS rallied back to close up 5%.

By no means are these “knock your socks off” results for the struggling retailers, but they’re not as bad as many expected. And in the current environment, sometimes “not that bad” is all it takes to spark a rally in these companies’ shares. 🤷