Clothing retailers continue to surprise to the upside this quarter. Let’s take a look at today’s winners.

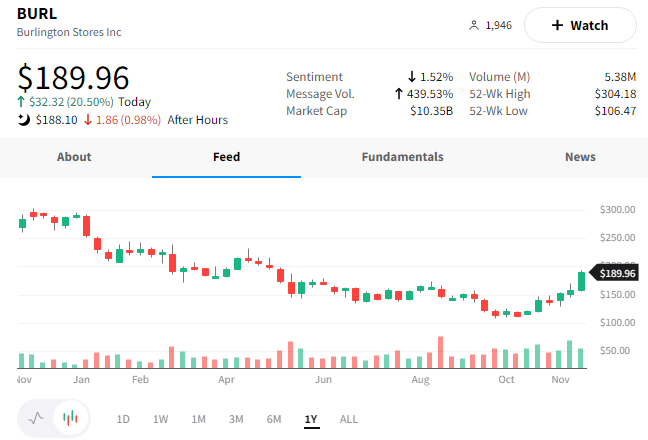

First is the off-price retailer Burlington Stores, which experienced a weak quarter but offered investors an upbeat 2023 outlook. 📆

The company said a challenging macroeconomic environment is a factor, noting its higher exposure to low-income consumers who are affected most by inflation. With that said, it also acknowledged some of its own missteps. CEO Michael O’Sullivan said it’s taking steps to improve its product mix and provide it an opportunity to raise prices and boost margins shortly.

Unlike its rivals, the company saw an uptick in sales in October and into November, allowing it to reaffirm its Q4 guidance. However, for next year it expects the improvements it’s making to result in stronger-than-previously-forecasted revenue and earnings.

Investors appear to be looking ahead, with $BURL shares rising over 20% today. 🔺

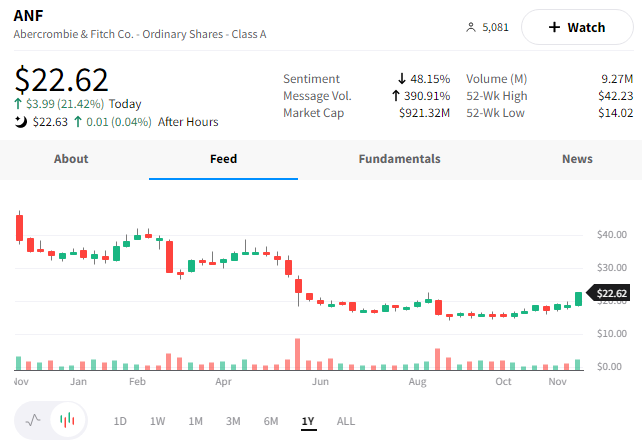

Meanwhile, mall retailer Abercombie & Fitch reported better-than-expected earnings and revenue.

The company’s $880.1 million beat expectations of $831.1 million, while a $0.01 in earnings beat the $0.14 loss expected.

Like other retailers, the company is cautiously optimistic about the holiday shopping season and says its inventory position is much better than last year’s. As a result of the improvements, it raised its full-year outlook to net sales of -2% to -3% vs. the mid-single-digit drop forecasted. 👍

Lastly, the company announced that Terry Burman is stepping down as Chairperson of the Board in January. The current director and chair of the Nominating and Board Governance Committee, Nigel Travis, will replace him.

Overall, the subtle improvements boosted $ANF shares by 22% today. 📈