Dick’s Sporting Goods surprised investors today by reporting record third-quarter sales and raising its full-year guidance. 😮

The retailer saw comparable store sales rise 6.5%, with net sales rising 7.7% YoY. Its pre-tax income as a percentage of net sales was 10.3%, more than 2.5x results from the same quarter in 2019.

As for the future, the company raised its full-year 2022 comparable store sales guidance to -3.0% to -1.5%, up from -6.0% to -2.0%. It also raised its earnings guidance significantly as the structural changes to its strategy continue to play out.

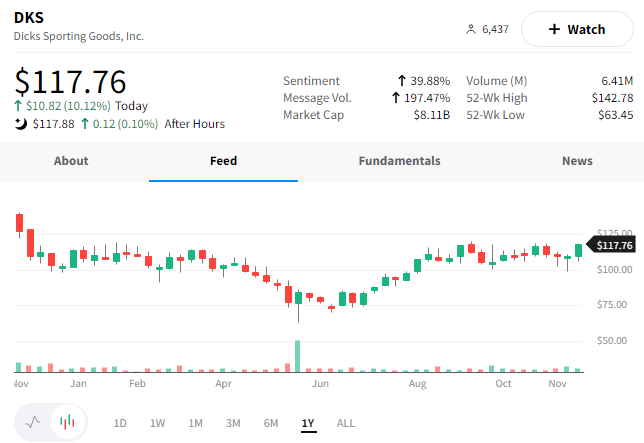

Overall, the news sent $DKS shares higher by 10% and towards the top of their 1-year price range. 📈