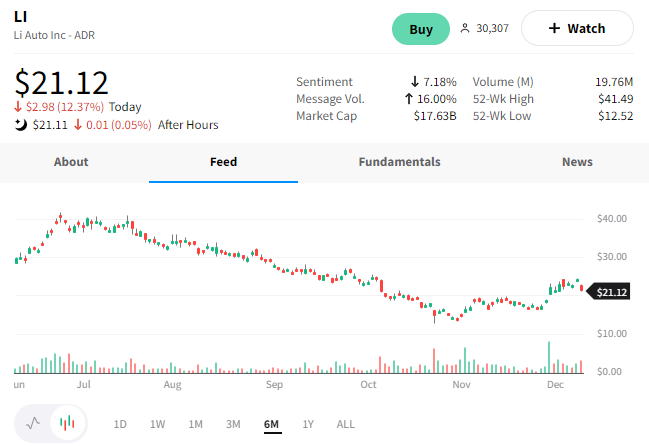

Chinese electric vehicle maker Li Auto veered off course today after missing earnings estimates.

The company saw revenues rise 20.25 YoY to $1.31 billion, missing estimates of $1.40 billion. Its Non-GAAP net loss per share was greater than expected at $0.18 vs. $0.15. ⚡

Getting into delivery numbers, Q3 rose 5.6% YoY to 26,524 vehicles. However, that represents a 7.5% QoQ decline.

More concerningly, its vehicle margin fell 910 bps YoY to 12%. Contracting margins pressured gross profit, which fell 34.8% YoY. Its gross margin contracted by 1,060 bps to 12.7%. 🔻

To become profitable again, the company’s chief engineer will replace its president and director, who recently resigned. The company is also rationalizing its costs and ramping production to benefit from economies of scale. However, they recognize they’re doing so in the face of an uncertain macro environment and supply chain issues.

Despite the challenges, management remains optimistic about their ability to execute and deliver 45,000-48,000 vehicles in Q4.

With that said, investors appear less confident as $LI shares fell 12% on the day. 📉

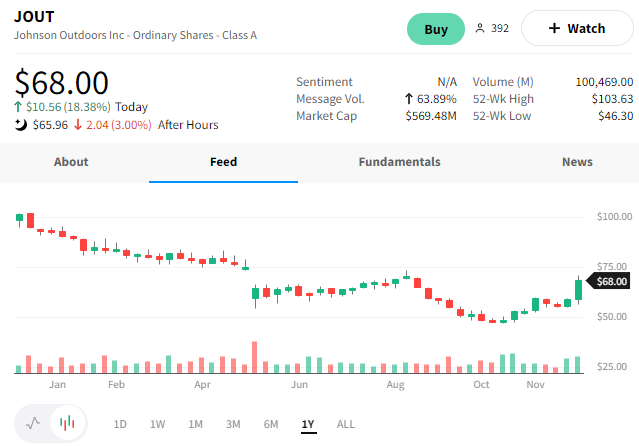

Meanwhile, small-cap outdoor recreational products retailer Johnson Outdoors surprised analysts with better-than-expected earnings. 😮

The company saw Q4 sales growth of 18% YoY to $196.39 million vs. the $168.57 million expected. Earnings per share of $0.95 also beat consensus expectations of $0.37 by a wide margin. 💪

Like other retailers, the company is dealing with gross margin contraction. However, they note the 620 bp YoY decline to 34.9% is primarily due to increased material costs and inventory reserves.

Overall operating expenses were up just 1% YoY, and operating margins of 6.8% were higher than expected. With that said, the company does expect supply chain constraints to occur periodically in 2023. And margins will remain impacted by higher prices.

Overall, investors seemed happy with the results. $JOUT shares rose 18% on the day. 👍