It was another Pinteresting day for shareholders as Pinterest reported fourth-quarter earnings. 📝

The company’s earnings per share of $0.29 beat the $0.27 expected. Meanwhile, revenues of $877 million missed the $886.3 million consensus estimate.

Global monthly active users rose 4% YoY to 450 million. And its average revenue per user (ARPU) for the U.S. and Canada rose 6% YoY to $7.60. 📈

Its guidance was also a disappointment. It now expects first-quarter revenue growth in the “low single digits” versus last year, well below the 6.9% analysts expected. It also announced that its CFO and head of business operations, Todd Morgenfeld, is leaving the company on July 1, 2023.

The company is struggling with the advertising slowdown facing the entire industry. However, Pinterest CEO Bill Ready says the company is “ready” for what’s ahead. He says they are adapting quickly to the environment and continue to create a more positive online experience for users and advertisers.

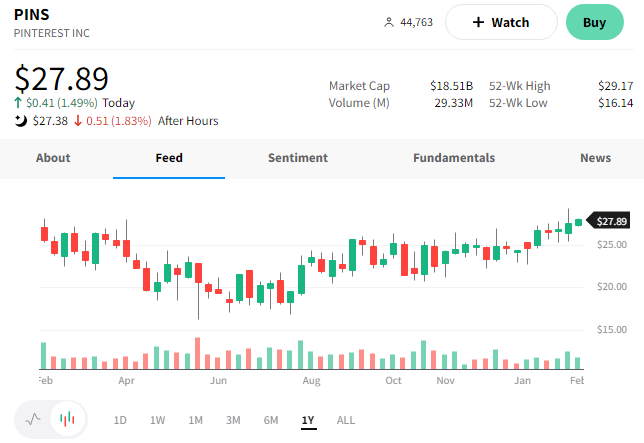

$PINS shares were initially down over 10% on the news, but prices recovered to nearly flat in extended hours. 😮