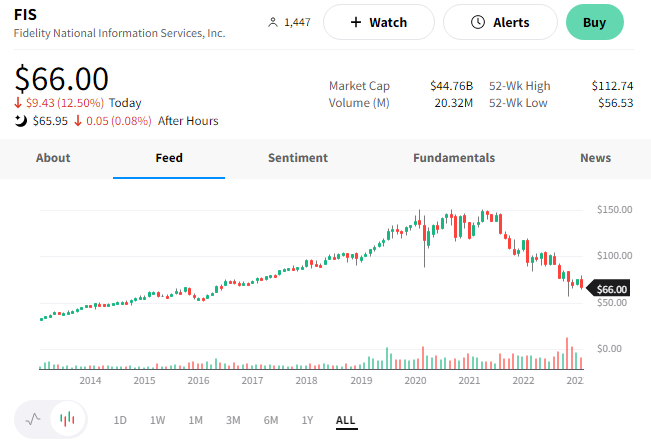

When people think of Fidelity, they think of a financial services company. However, there’s a $45 billion IT services provider called Fidelity National Information Services listed on the New York Stock Exchange.

And today, that company is making headlines after announcing weaker-than-expected results and a spin-off. 📰

The payments giant announced that it plans to spin off its merchant business, essentially reversing its $43 billion acquisition of Worldpay in 2019. It expects to complete the tax-free spin-off within a year, saying the companies will maintain a commercial relationship. Additionally, the split will allow its core business to secure a solid investment-grade credit rating and allow Worldpay to invest more aggressively for growth.

The decision comes as new CEO Stephanie Ferris leads a strategic review of the company’s business and operations. Analysts say the decision highlights the weakness in its core business and that the “sum of the parts” clearly indicates the two businesses could create more shareholder value as separate entities. 🧮

Additionally, its fourth-quarter earnings barely topped estimates. Its full-year 2023 earnings guidance of $5.70 to $6.00 per share was well below the $6.57 consensus forecast.

$FIS shares fell another 12% today. It’s now 56% off its 2021 all-time high. 🔻