Retail news continues, with an array of retailers reporting. Let’s see who we heard from and what they had to say. 🛍️

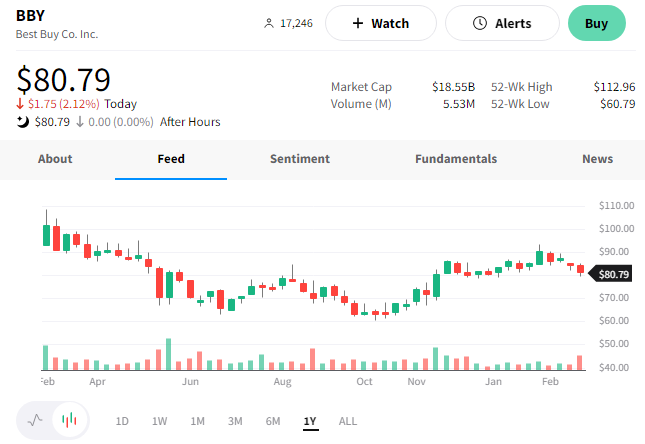

First up is Best Buy, which reported better-than-expected holiday-quarter earnings and revenue. 🎁

Adjusted earnings per share of $2.61 and revenues of $14.74 beat the expected $2.11 and $14.72 billion. Cost-cutting measures and increased promotional activity helped drive the results. Same-store sales declines and other metrics largely aligned with the company’s reduced forecast.

Executives say inflation, the weaker economy, and consumer spending shifting away from discretionary goods will further impact results this year. As such, they expect full-year revenue to decline marginally to $43.8 to $45.2 billion, and same-store sales will fall by 3% to 6%. 🔻

Like other big-box retailers, the company is spending roughly $200 million this year to revive its storefront portfolio. It hopes these adjustments will help bring margins back to pre-pandemic levels and “stay relevant in an increasingly digital age.”

$BBY shares were down 2% on the day.

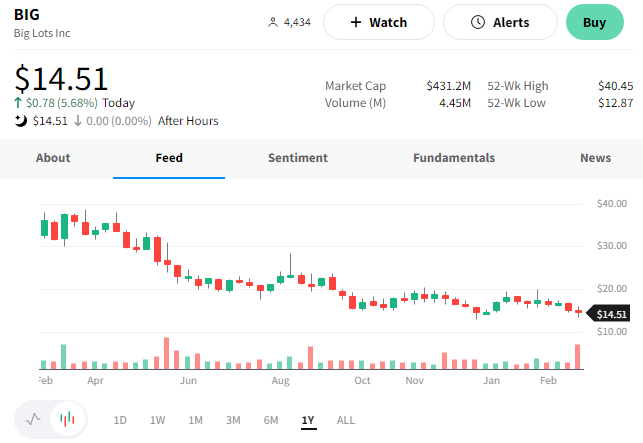

Meanwhile, discount retailer Big Lots benefitted from higher-income consumers looking for bargains. 🛋️

The furniture and home-decor retailer posted a narrower-than-expected fourth-quarter loss. Its adjusted loss per share was $0.43 vs. the $0.85 expected.

Same-store sales fell 13%, driving net sales down 10.9% to $1.54 billion. That was just shy of the $1.55 billion expected and was impacted by increased promotional activity to clear out unwanted inventory. It was also affected by its largest vendor, United Furniture Industries Inc., ceasing operations and filing for bankruptcy. 😬

Sales of furniture and home products fell double digits during the quarter as customers postponed big-ticket discretionary purchases. 📆

The cost-cutting measures and clearing in inventory helped spur optimism and boosted $BIG shares by 6%. 👍

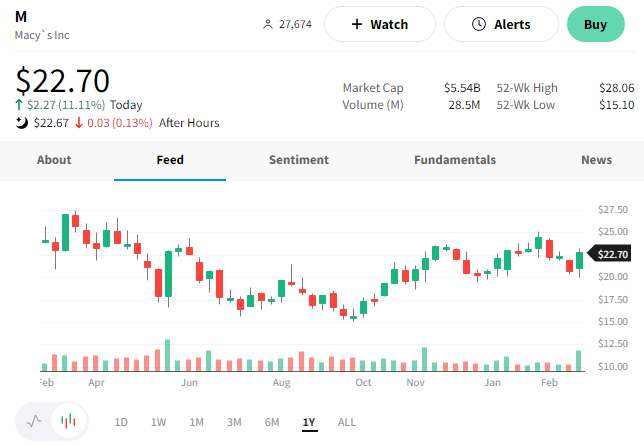

Last up is department store operator Macy’s, which reported better-than-expected holiday-quarter results. 🥳

Its adjusted earnings per share of $1.71 beat the $1.57 expected, while revenues of $8.26 billion matched expectations.

The company continues to focus on its private brands, opening more off-mall stores and growing its luxury business and online marketplace. Its inventory management has also been better than other retailers, allowing it to “hold the line” on pricing even as competitors discounted heavily. 💵

With that said, executives expect a choppy year ahead. They see full-year net sales declining between 1% and 3% and adjusted diluted earnings per share of $3.67 to $4.11. Inflation, consumer habits changes, and the overall macroeconomic environment are driving that weakness.

$M shares were up nearly 11.11% on the day (make a wish). 🌠

Bonus stock: Costco reported after-hours and missed revenue estimates. It’s singing the same tune as its peers, saying that inflation and a weaker macro environment are causing consumers to cut back on discretionary purchases and focus on necessities. Speculation continues around whether the membership-only chain will raise the price of its memberships, but no official news on that yet. $COST shares are down roughly 3% on the news.