It was a rough day in the markets, but several stocks started the morning off strong and remained so throughout the day.

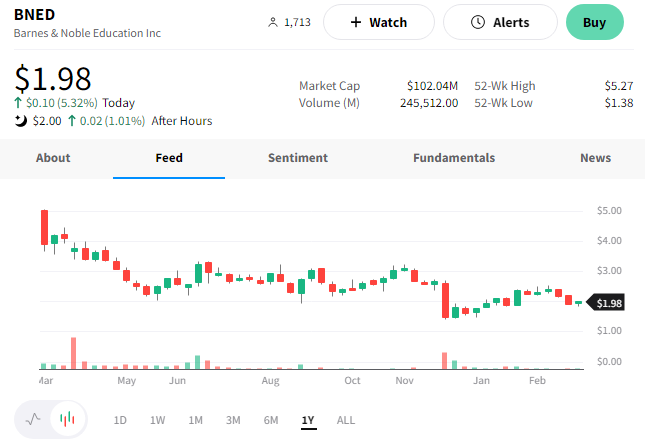

The first was Sea Ltd., which operates one of Southeast Asia’s largest e-commerce and digital entertainment platforms. 🛒

The company earned $0.72 per share on $3.45 billion in revenue. Analysts expected a loss of $0.64 per share on revenue of $3.05 billion.

Like other tech companies, the company pivoted to focus on profitability late last year amid slowing revenue growth. Executives say those decisions are beginning to pay dividends, with the company continuing its transition and focusing on sustainable growth into 2023. 📈

Overall, the surprise profit helped boost $SE shares by 22%. 💰

Second was Dick’s Sporting Goods, which posted a better-than-expected holiday quarter. 🏈

It reported adjusted earnings per share (EPS) of $2.93 and revenues of $3.60 billion. That topped the $2.88 per share and the $3.45 billion revenue expected. The company’s same-store sales rose 5.3% in the fourth quarter, exceeding Wall Street’s 2.1% expectation. 😮

Like other retailers, it said gift-giving helped boost sales despite inflation pressuring consumers. Footwear, athletic apparel, and team sports products were the strongest categories for all of 2022 as consumers began to view them more as necessities than discretionary purchases.

Additionally, the company’s efforts to pare back its distribution partners and other costs helped boost profits. It now feels that supply chain and inventory challenges are behind it, with stabilized inventory levels allowing it to focus on growth. 📦

As a result, executives say the company is positioned well for the year ahead. They anticipate full-year EPS of $12.90 to $13.80, topping the consensus estimate of $12.00. In addition, same-store sales growth is expected to be 0 to 2%, with strength in the first half of the year.

$DKS shares rose 11% today to fresh all-time highs. 🏅

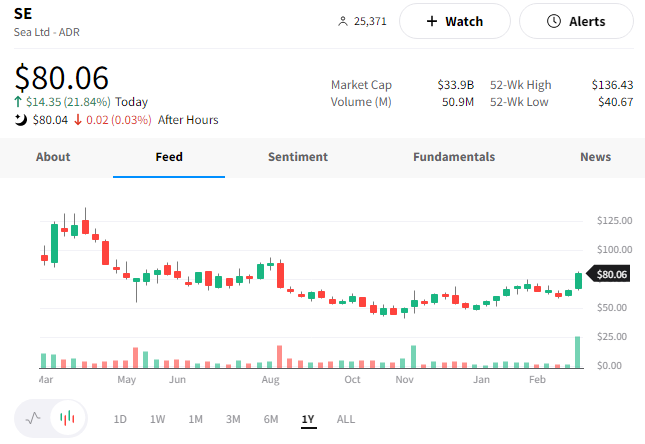

And the third was Barnes and Noble Education, which many of you probably didn’t realize was a public company. It was spun out from the Barnes & Noble national retail bookstore chain in 2015 and has had a rough ride since. 😯

The company was supposed to report earnings today but instead pushed its release to after the market close on Thursday, March 9th. Executives say they need adequate time to close on the company’s amended and extended asset-backed revolving and term loan credit facilities.

Despite the delay, $BNED shares were actually up over 5% today. We’ll have to see if that optimism is warranted after it reports on Thursday… 🤷