Software company MongoDB reported fourth-quarter results that beat expectations. But its outlook left investors wanting more… 😑

The company reported adjusted earnings per share of $0.57 and revenues of $361.3 million. The consensus estimate was $0.07 and $339.3 million. 👍

With that said, the economic slowdown impacted the company’s outlook for the coming quarter. It now expects revenues of $344 to $348 million, which fell short of the $354.7 million expected by analysts. Its adjusted earnings per share forecast of $0.17 to $0.20 topped estimates of $0.14 as its cost-cutting and operational focus are starting to pay dividends.

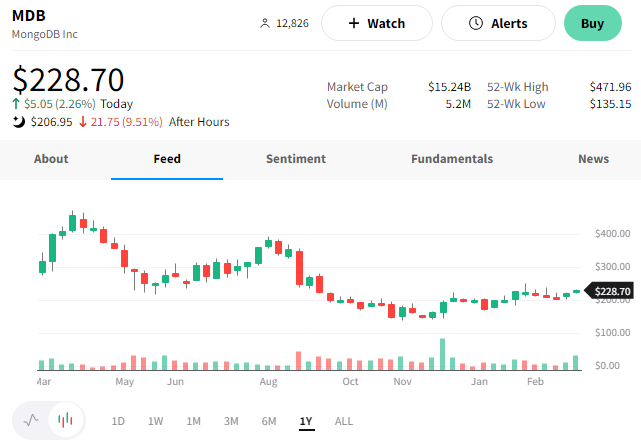

Overall, the slowdown in sales growth seemed to take precedence over its earnings improvements with investors. $MDB shares were down nearly 10% after the bell. 👎