American clothing brand and retailer Guess? reported earnings today that sent shares tumbling. 🔻

Its fourth-quarter adjusted earnings per share of $1.74 on $817.8 million in revenue topped the expected $1.30 and $772 million.

Driving the strength was strong European sales, though currency fluctuations reduced operating profit by $62 million and operating margin by 1.40%. Accessory sales were also a strong point, with handbags, leather goods, travel products, fragrances, jewelry, and eyewear all strong. Its Marciano brand of activewear dresses also performed well. 👜

Ultimately, the company’s holiday-quarter results surpassed even its own expectations. However, executives offered a more cautious outlook for fiscal 2024. ⚠️

The company expects low single-digit revenue growth but solid profit performance and strong cash flow generation. Its full-year earnings per share estimate of $2.45 to $2.80 was well below the $3.41 consensus view. And revenue growth of 1%-3% fell short of the 3.9% expected.

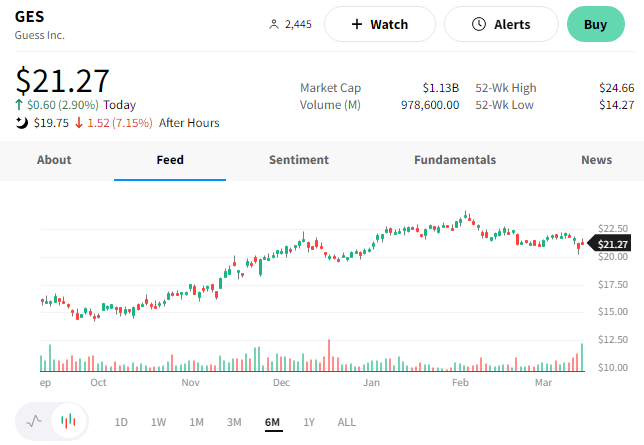

$GES shares were down roughly 7% on the news as investors look ahead to a weaker-than-expected future. 📉