Athletic-wear retailer Lululemon’s stock is going for a run after reporting better-than-expected holiday-quarter sales.

The company’s adjusted earnings per share of $4.40 on revenues of $2.77 topped the expected $3.26 and $2.7 billion. 👍

Other important stats included:

- Comparable store sales rose 15% YoY (17% constant dollar basis)

- Direct-to-consumer net revenue rose 37% YoY (39% constant dollar basis)

- Direct-to-consumer net revenue as a percentage of total revenue rose 3% YoY to 52%

- Adjusted operating margin rose 50 bps YoY to 28.3%

- Inventories grew 50% YoY to $1.4 billion (down from +85% YoY growth in Q3)

The company took a significant write-down on its acquisition of MIRROR, now rebranded as Lululemon Studio. Executives say they will build on the two-tier membership program launched in October 2022, expanding features to guests at a lower price point. They hope this will drive digital app-based services in the future.

Looking ahead, executives expect fiscal 2023 revenue of $9.3 to $9.41 billion and earnings per share of $11.50 to $11.72. Both forecasts topped consensus estimates of $9.14 billion and $11.26 per share. They continue to focus on delivering sustained growth and long-term value. 💪

There was not much mention of the macroeconomic environment or a consumer slowdown. Maybe the company’s focus on middle to higher-income consumers has isolated it from much of the slowdown other retailers are experiencing. Nevertheless, changes in the company’s outlook are something investors will likely watch for in the coming quarters.

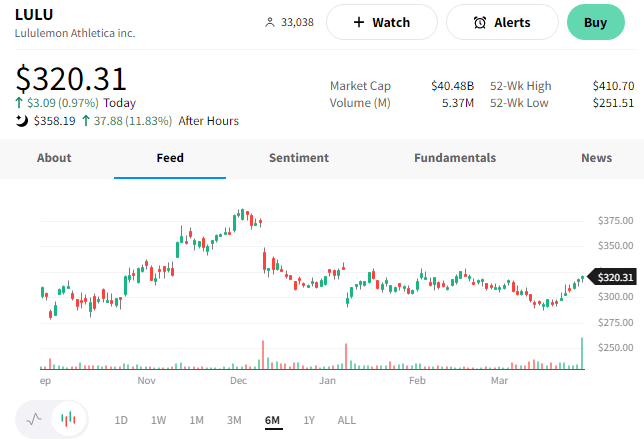

$LULU shares rallied 13% after hours. 📈