Home furnishing retailers Conn’s and RH reported today, with one popping and the other dropping. 🏬

First, let’s start with Texas-based retailer Conn’s.

The company reported a $1.53 loss per share on revenues of $334.9 million. That loss was wider than the $0.86 loss per share expected by analysts, with revenue marginally missing forecasts as well.

The company’s core customers remain credit constrained and face significant macroeconomic headwinds. That, plus consumers’ shift from discretionary goods to necessities and services, is along the same lines as we’ve heard from every major retailer. ⚠️

Same-store sales declined by 21.8% YoY, driven by home office and consumer electronics weakness. Retail gross margins also contracted amid higher costs and promotional activity. Executives anticipate this fiscal year to be challenging but are focused on long-term growth through e-commerce (DTC) investments and opening 11 new standalone locations. 🛒

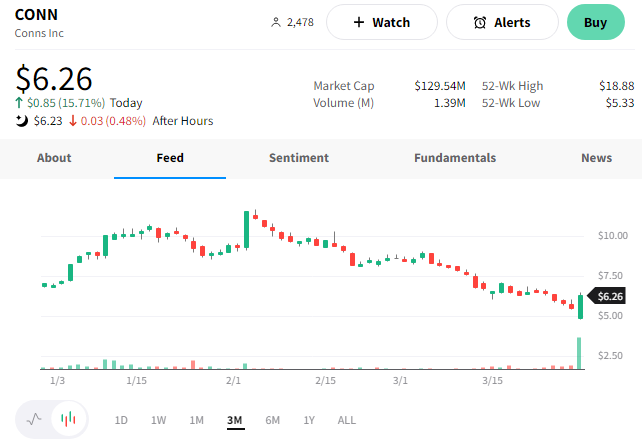

$CONN shares were volatile today. They initially fell sharply but regained altitude to close by +16% on the day. 🤷

Higher-end home furnishing company RH reported a similar slowdown, but for different reasons.

The company’s $2.88 earnings per share missed estimates by $0.48. And revenues declined 14.4% YoY to $772.5 million, also missing Wall Street estimates. 👎

Driving this weakness was a slowdown in spending from the company’s higher-income consumer base. Slumping luxury home sales, a weak stock market, and the recent banking crisis are all weighing on the confidence of those higher-end consumers. And on top of that, the company is still dealing with record-high pandemic-era comps, where many sales were potentially pulled forward.

Essentially, its consumer base’s willingness to spend is tied to how wealthy they feel. Since asset prices across the board have come down and there remains a lot of uncertainty about the economy, they’re likely to remain cautious. ⚠️

That’s reflected in RH executives’ cautious outlook. They now expect fiscal 2023 revenues of $2.9 to $3.1 billion, well below the $3.46 billion analysts expected. And an adjusted operating margin of 15% to 17% also left much to be desired. And its first-quarter forecast for revenues and adjusted operating margin were also well below consensus estimates.

As a result, the company is remaining cost disciplined. Its recent organizational redesign eliminated about 440 roles and should save about $50 million. And executives continue to focus on reducing inventories, generating cash, and strengthening the company’s overall financial position to weather the slowdown. 💰

$RH shares were down about 5% after hours, sitting near a 1-year low. 🔻