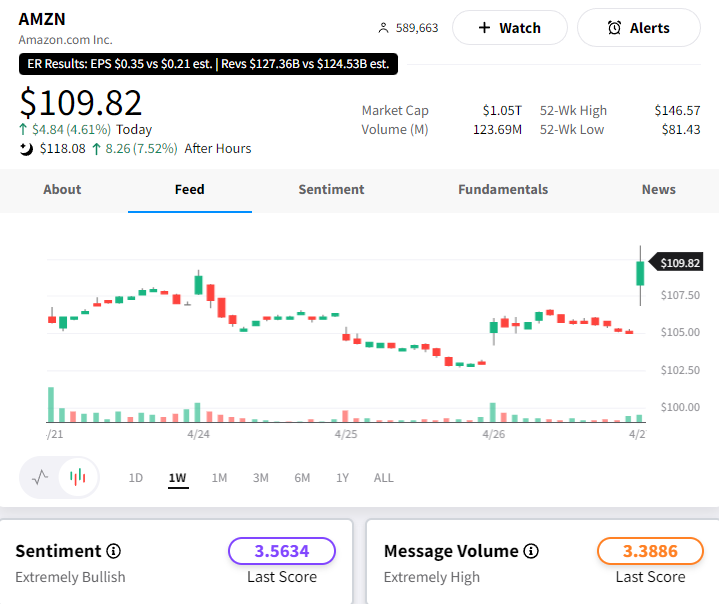

Amazon shares soared after-hours trading following the company’s Q1 earnings report, which exceeded expectations in multiple areas. Key figures from the report, in comparison to Bloomberg analysts’ estimates, include:

- Net sales: $127.36 billion (actual) vs. $124.7 billion (estimated)

- EPS: 31 cents (actual) vs. 20 cents (estimated) 😲

- Amazon Web Services (AWS) net sales: $21.35 billion (actual) vs. $21.03 billion (estimated)

- Operating margin: 3.7% (actual) vs. 2.38% (estimated)

- Q2 net sales guidance: $127-133 billion (actual) vs. $130.1 billion (estimated)

CEO Andy Jassy praised the company’s performance, highlighting improvements in fulfillment network costs and the fastest Prime delivery speeds expected in 2023. He attributed robust advertising growth to ongoing machine learning investments that enhance customer engagement and deliver strong results for brands. 🚛

Although Q1 AWS results relieved Amazon investors, Jassy expressed caution about the cloud business’s prospects in the current macro environment. He emphasized AWS’s long-term plans, focusing on building customer relationships, enabling cost savings, and leveraging technologies like Large Language Models and Generative AI. Jassy remains optimistic about AWS’s future growth. 🤖