Mall retailer Gap is popping after hours following a narrower-than-anticipated loss. 🤏

The company’s adjusted earnings per share were $0.01, driven by drastic cost-cutting efforts over the last year. Heavy discounting to clear inventory and high air freight expenses had weighed on margins last year but are abating. As a result, gross margins of 37.1% were up 5.6% YoY and 3.5% QoQ.

Meanwhile, revenues fell 6% YoY to $3.28 billion, just shy of estimates. Comparable sales were down 3%, and store sales dropped 4%. Online sales dropped a more drastic 9%, though executives say it’s primarily due to sales trends returning to historical norms well above pre-pandemic levels. 🛒

Here is how its main brands performed: 🏬

- Old Navy sales -1% YoY to $1.8 billion, comparable sales -1%

- Gap sales -13% YoY to $692 million, comparable sales +1%

- Banana Republic sales -10% YoY to $432 million, comparable sales -8%

- Athleta sales -11% YoY to $321 million, comparable sales -13%

The company acknowledged the challenges ahead, saying it’s working hard to understand its consumers better. It’s also working to establish new leadership that can help drive initiatives to regain its market share and reaccelerate sales. That said, it maintained its full-year outlook for a net sales decline in the low to mid-single-digit range. It’s also expecting continued gross margin expansion as it reduces capital expenditures by $500 to $525 million. 🔺

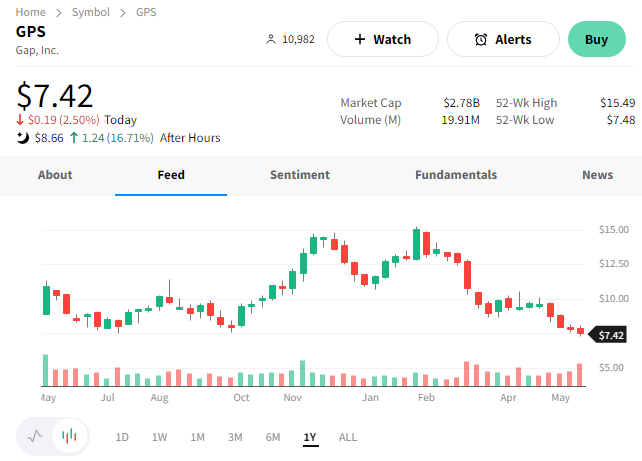

$GPS shares rebounded 15% from one-year lows on the news. Investors will be watching to see if this rebound lasts in the days and weeks ahead. 👀