It’s been rough for public company investors in the cannabis space…and things didn’t improve today. 😬

Canadian company Aurora Cannabis reported a wider-than-expected loss of C$87 million. It said changes in the fair value of derivative investments drove most of the comparatively high loss.

Revenues rose to C$64 million, driven by strength in its consumer segment, which rose from C$4.2 to C$14.5 million. However, its largest segment, medical cannabis, experienced a 3% decline to C$38 million. 🔻

On the positive front, it achieved its second straight quarter of positive adjusted EBITDA. And its balance sheet remains strong, with $230 million in cash and $80 million of convertible notes outstanding. Executives believe they remain on the path to positive free cash flow by the end of calendar year 2024, primarily driven by $40 million of annualized cost efficiencies.

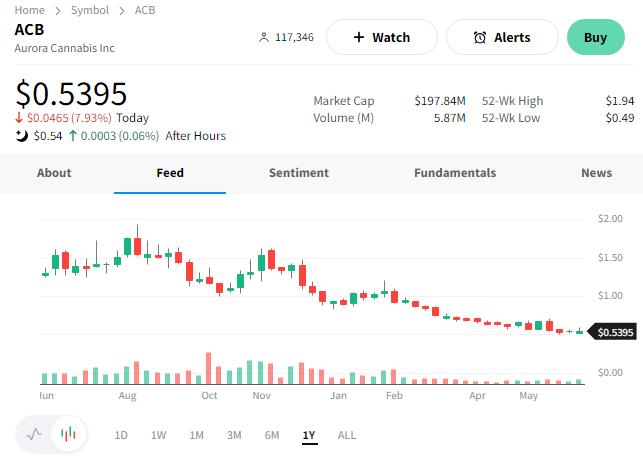

While some investors trust executives’ long-term plan will deliver positive results, its stock has been crushed. $ACB shares are down over 99% from their 2019 highs and continue to trend lower. They were down another 8% today, approaching all-time lows set two weeks ago. 📉

That leaves many questioning whether it will have the runway as a public company to execute its plans. And that’s a question many in the space are asking, as many of its peers have experienced similar fates in the public markets. Time will tell. 😶🌫️