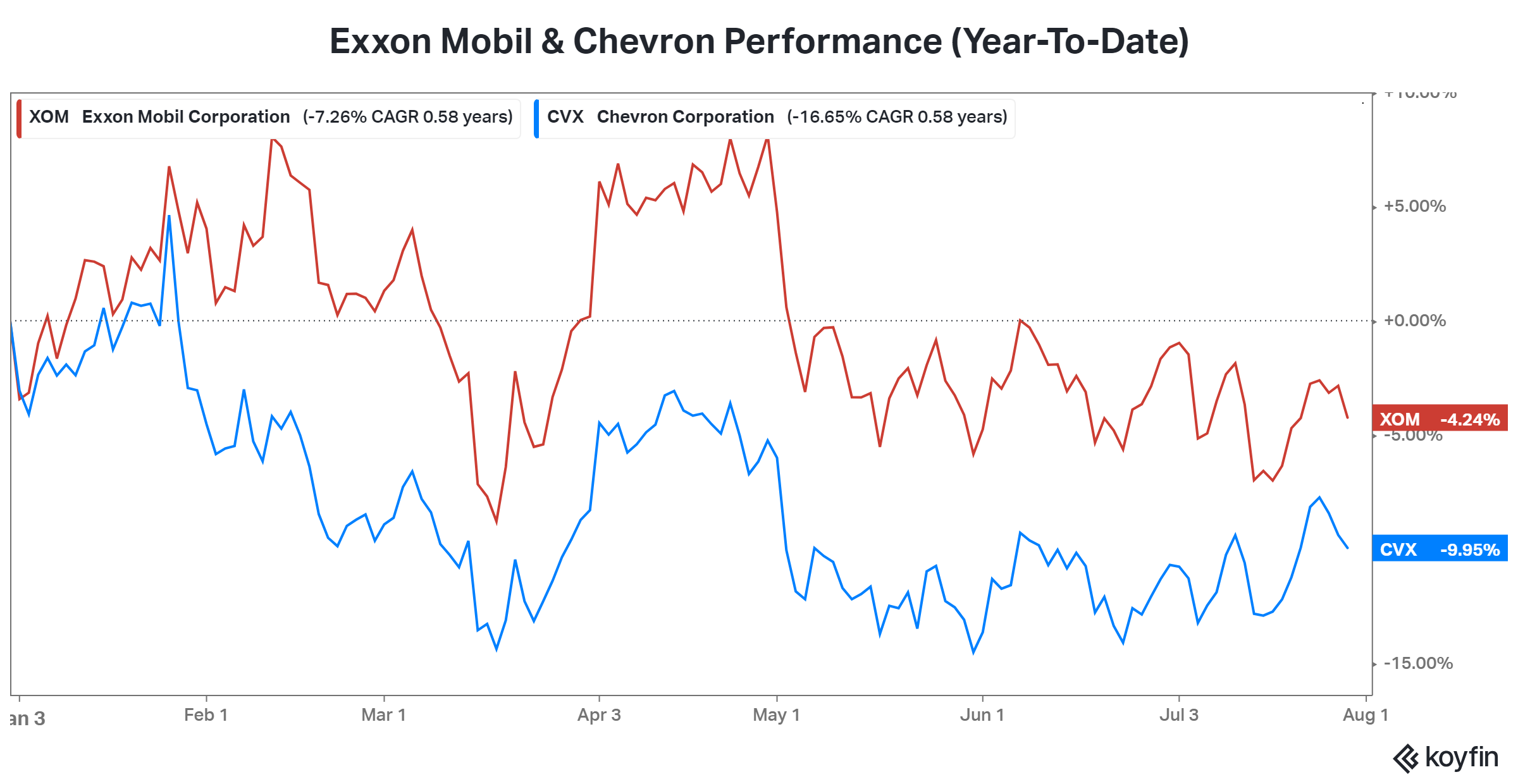

Oil majors made record profits last year on high oil prices and refining margins. However, falling prices through the first half of this year have weighed on results. Let’s take a look. 👀

Exxon Mobil reported adjusted earnings per share of $1.94 vs. the $2.03 expected. Revenues of $82.9 billion topped estimates of $81.80 billion.

A 40% YoY decline in natural gas prices drove the fall, which had been partially forecasted by management. Executives revised their estimates lower by 12% over the last month as the stock pulled back. But overall, the company says we’re back to a more normal environment for prices and profits. 🔻

Chevron’s results also echoed that sentiment. Although its $3.08 earnings per share topped estimates of $2.91, revenue slipped 29% to $48.90 billion. Net production grew 4% to a new quarterly record of 1.22 million barrels of oil equivalent per day, driven by Permian Basin strength. 🛢️

The company continues to invest in U.S. production, purchasing PDC Energy in May for $6.3 billion.

Overall, the days of bumper profits for the oil giants are behind us. But they’re still above pre-pandemic levels, and the recent uptick in energy commodities suggests they could have a tailwind in the year’s second half. Despite that, investors remain cautious about the stocks after their strong performance since late 2020. ⚠️