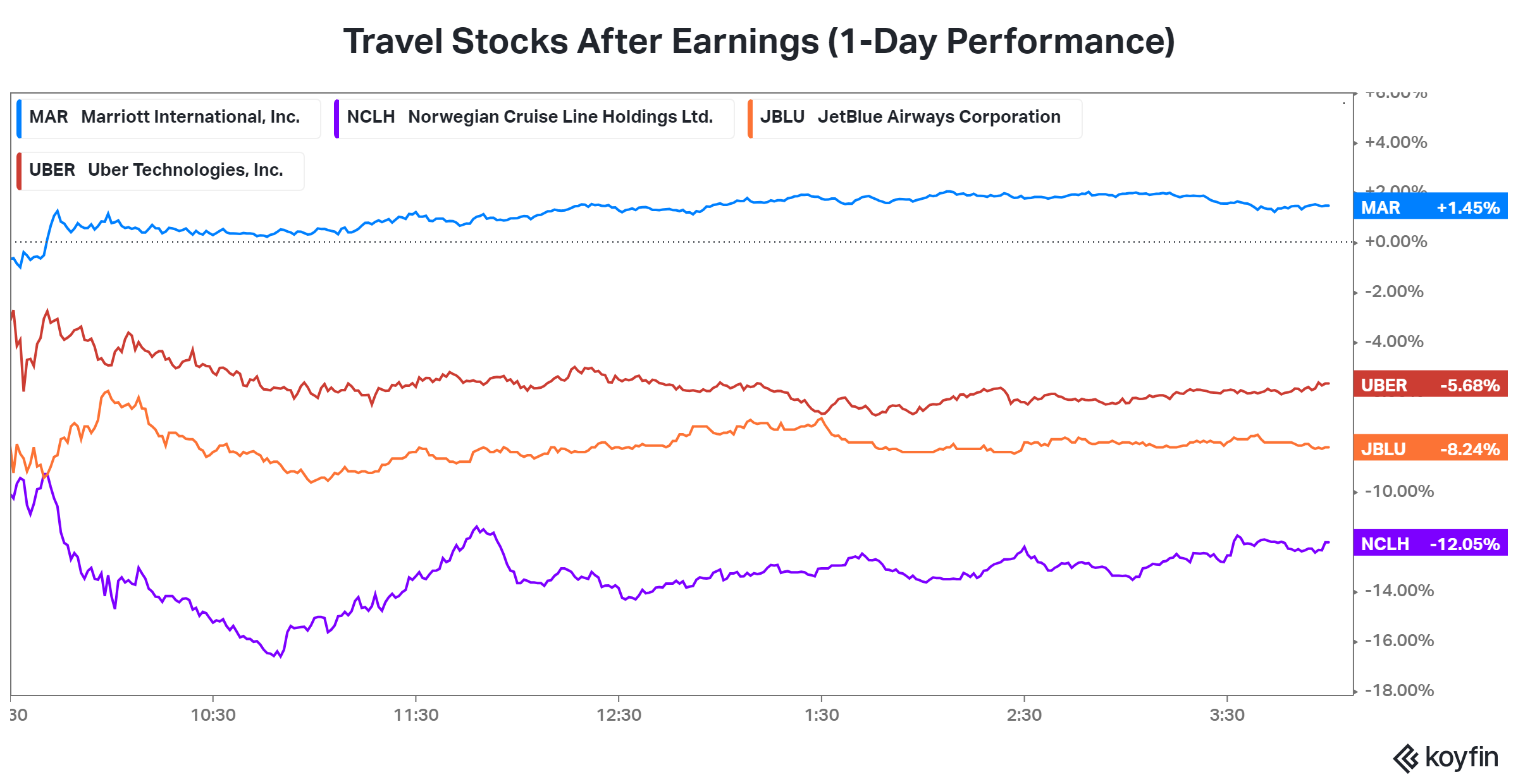

It remains a mixed bag for travel stocks this earnings season, with several big players reporting today. Let’s recap a few. 👇

JetBlue Airways fell 8% after saying it doesn’t expect to post a profit during the third quarter, cutting its full-year earnings guidance from $0.70-$1.00 to $0.05-$0.40. Its second-quarter earnings and revenue were essentially in line with expectations and at the top of the company’s previous guidance. ✈️

Consumers shifting their leisure travel from domestic to international weighed on its results, as well as company-specific issues like ending its Northeast partnership with American Airlines.

Norwegian Cruise Lines faced a similar issue, delivering strong second-quarter results but whiffing with its third-quarter guidance. The cruise operator now expects $0.70 per share in earnings, missing the $0.80 consensus estimate in what’s typically its strongest period of the year. 🚢

Uber shares initially popped, then dropped after its second-quarter earnings report. Revenues of $9.23 billion missed expectations by $0.10 billion. Notably, the company earned its first GAAP profit of $0.18 vs. the expected $0.01 per share loss. However, when looking under the surface, nearly all of that was due to a $385 million pre-tax benefit from unrealized equity investment gains. 🚗

Mobility gross bookings again topped delivery, and the company’s freight business remains challenging amid weak goods demand.

Marriott International had the best day, with shares rising to new all-time highs after earnings. Its second-quarter results topped expectations due to international strength, causing the hotel operator to raise its full-year outlook. 🏨

Overall, many of these travel stocks have rallied sharply this year, raising the bar for what investors expect from their businesses. Investors’ primary concern remains how much better these businesses can perform, especially given concerns consumer spending will eventually wane. Time will tell. 🤷