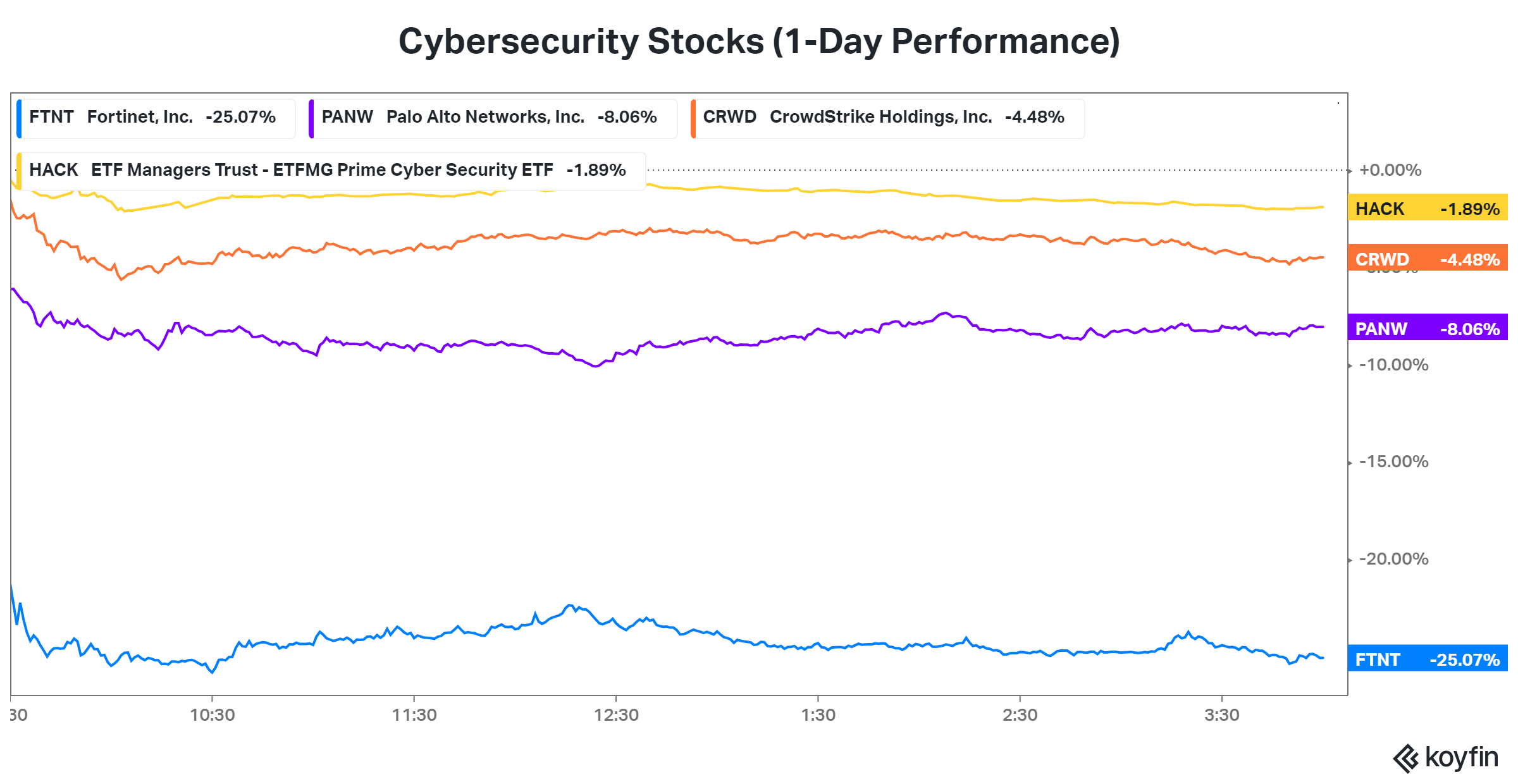

Similar to the real estate tech industry, cybersecurity stocks have experienced quite a rebound this year. Unfortunately, today’s outlook from Fortinet sent the sector plummeting. 📉

The cybersecurity company plunged 25% and dragged the sector lower after warning that companies are delaying deals due to macroeconomic uncertainty. More specifically, CFO Keith Jensen said “an unusually large volume of deals” expected to close in June was pushed out to future quarters. That ultimately impacted the company’s billings. 📆

As a result, the company’s third-quarter guidance for revenues of $1.315 to $1.375 billion fell short of the $1.38 billion expected. That, combined with its narrow revenue miss this quarter overshadowed a $0.04 beat on earnings. 🔻

Cybersecurity wasn’t the only industry being impacted by economic uncertainty today.

Shipping giant Maersk also remains cautious about the global economy, given that the rebound it anticipated in the year’s second half hasn’t developed yet. It cited slower economic growth and its customers reducing inventory as it adjusted its full-year guidance. Executives expect container volumes to fall as much as 4% YoY vs. its previous 2.5% estimate. ⚠️

Although the market is looking for a “soft landing,” there’s still room for slowing growth without a recession. And that’s what we may ultimately be experiencing in the economy and markets. 🤷