Luxury goods conglomerate LVMH was the talk of the town earlier this year after it briefly became Europe’s most valuable company by topping a $500 billion valuation. However, it’s seen a slow descent back to Earth since then. Today, that trend continued, with shares falling another 7% after management’s comments stoked growth fears. 😰

Third-quarter revenues grew 9% YoY to roughly $21 billion, down from a 17% increase in the second quarter. Driving the decline was a 14% YoY decline in sales from its wines and spirits division. And Asia’s slow recovery continues to weigh on results, with revenues from Asia excluding Japan rising just 11% YoY, down from 34% in the second quarter. 🔻

CFO Jean-Jacques Guiony had this to say, “After three roaring years, and outstanding years, growth is converging toward numbers that are more in line with historical average.”

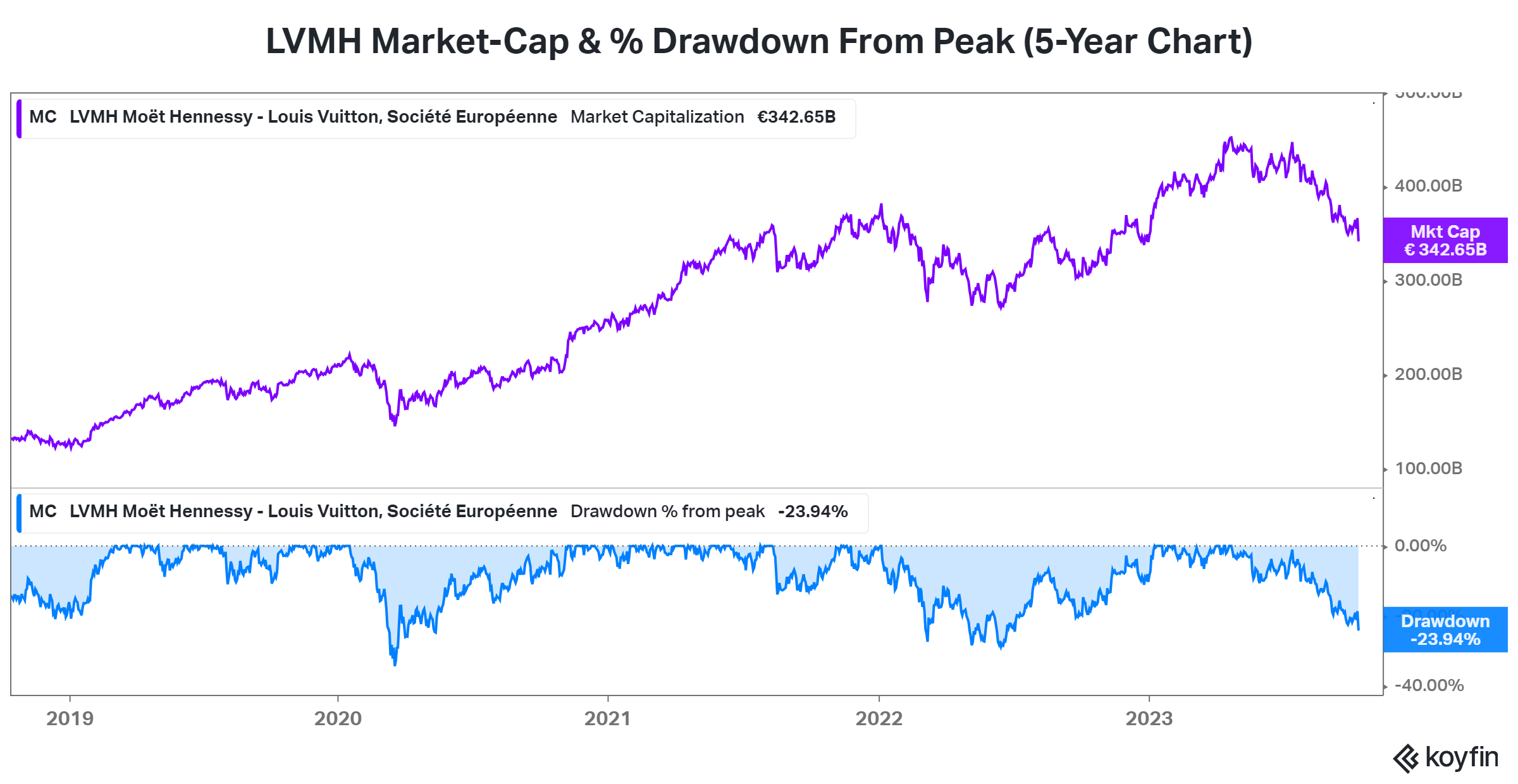

While average growth may be acceptable in some environments, it’s much harder to swallow after your stock has experienced a significant rally. With the stock extending its recent drawdown to 24%, it’s clear the market was expecting above-average growth to justify recent above-average returns. 👎

It’s unclear where the stock will find its footing. But what is clear is evidence is building that even the higher-end consumer is beginning to pull back. And that means management at LVMH and its peers will likely need to do more to reset expectations among stock market investors. 🔮