Big banks continued to report earnings today, so let’s explore some of the key themes. 👇

We’ll start with Bank of America, which beat earnings and revenue estimates. Its adjusted earnings per share of $0.90 on revenues of $25.32 billion beat the $0.82 and $25.14 billion expected.

Driving the results was a 4% YoY increase in interest income. The $14.4 billion topped estimates by $300 million, while its provision for credit losses of $1.2 billion was $100 million less than anticipated. CEO Brian Moynihan said the bank added clients and accounts across all business lines despite growing signs of an economic slowdown. 🔺

While a strong consumer continues to prop up the bank’s results, investors remain concerned about its significant exposure to low-yielding, long-dated securities accumulated during the pandemic. Unrealized losses continued to rise in the quarter as interest rates continued their upward trajectory. It saw $131 billion in unrealized losses in its held-to-maturity bond portfolio, driven by a decline in mortgage securities’ value.

CFO Alastair Borthwick reaffirmed guidance on net interest income for 2023, saying it will trough in Q4 and begin to grow again in mid-2024. 💵

Bank of New York Mellon also benefited from higher interest rates, beating earnings and revenue expectations. Its $1.22 in adjusted earnings per share on $4.4 billion in revenues topped the $1.15 and $4.3 billion anticipated by Wall Street.

Net interest revenue at BNY Mellon jumped 10% YoY as its higher-margin lending business picked up steam. With that said, it has faced a deposit flight like Charles Schwab and other smaller banks, with average deposits falling 5.4% QoQ to $262.1 billion. 💸

However, it’s important to remember it’s not a conventional bank, with a significant portion of its business focused on investment services. While the 2023 market rebound has helped buoy results there, it remains a challenging environment for this aspect of its business. So, investors will be keeping a close eye on it going forward. 👀

Finally, let’s shift to Goldman Sachs, which has been running away from the “consumer banking” business as fast as possible. Of the big U.S. banks, Goldman is the most reliant on investment banking and trading revenues, so let’s see how those did.

Bond revenue fell 6% YoY to $3.38 billion but topped analyst estimates by $600 million. Fixed income financing revenue rose to a record $730 million, driven by strength in lending activities. 💵

Equities trading revenue also jumped 8% YoY to $2.96 billion, topping estimates by $200 million. And investment banking saw a meager 1% YoY rise to $1.55 billion, above the $1.48 billion estimate.

The company’s $5.47 in adjusted earnings topped the $5.31 expected, with revenues of $11.82 billion vs. $11.19 billion anticipated. The sale and disposal of its specialty lender, GreenSky, as well as other consumer-lending efforts, has weighed on profits. In addition to asset sales, it’s had to write down some asset holdings, like commercial real estate, by as much as 50%. ✂️

All in all, it was a slightly better quarter for Goldman. However, now that it’s retreated from its consumer banking efforts, analysts and investors want to see how it will diversify its core business. It’s expected to lean heavily into wealth and asset management like Morgan Stanley but remains behind the curve.

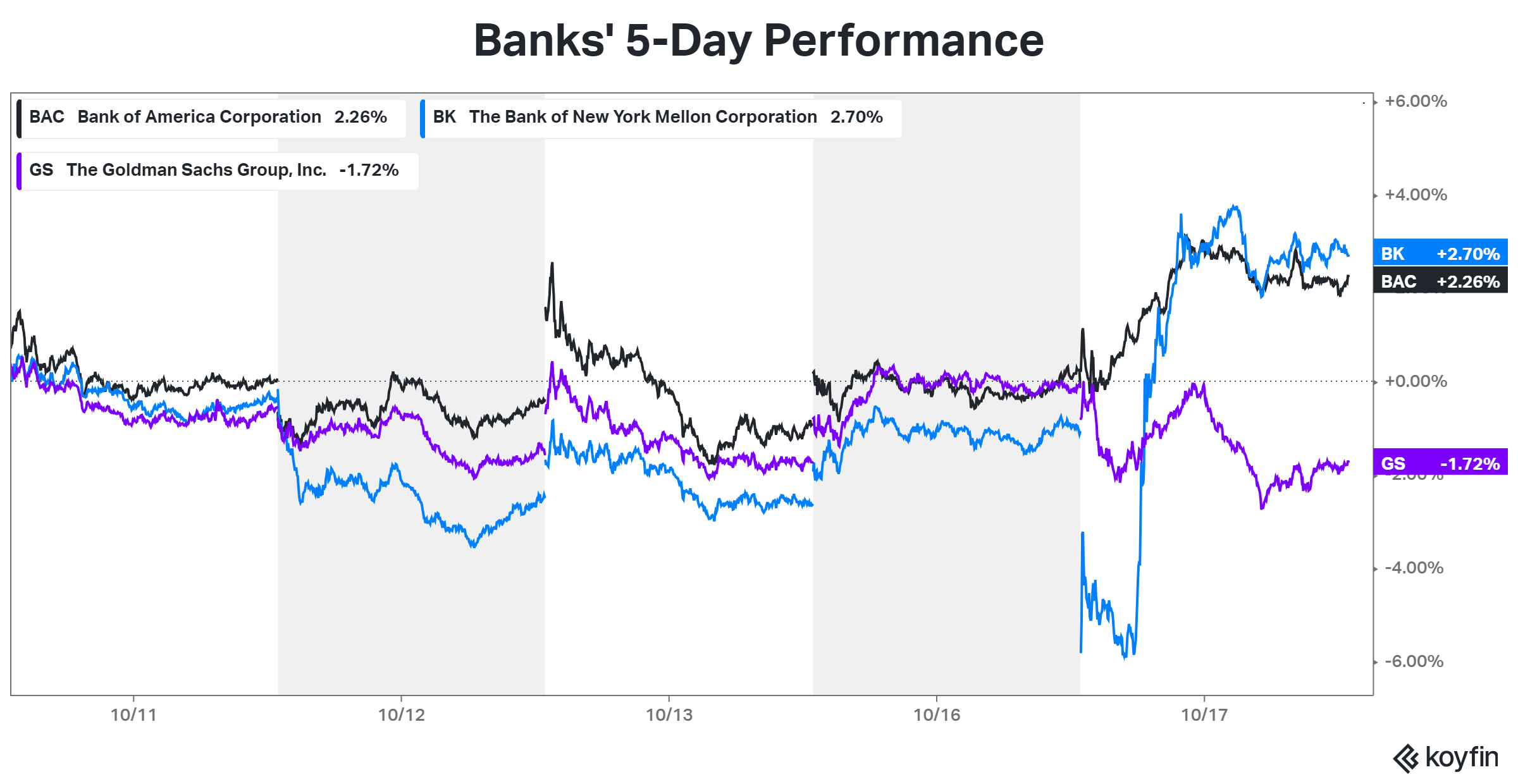

Let’s see how the three stocks performed today and then recap. 📝

Overall, it remains a good time to be in the consumer banking business. A strong labor market keeps consumer balance sheets and spending high while limiting loan losses (for now). And elevated interest rates are allowing those banks that can hang onto deposits to make a lot of interest income in the current environment. 💪

As for Goldman Sachs and other “dealmakers,” the current environment remains challenging. Dealmaking has recovered modestly since 2022, as have public markets, but is expected to remain difficult in the current climate. 🌦️