Two important railroad companies reported today. And although they both stayed on the rails, the title off the rails sounded a lot more catchy. So let’s see what happened. 👀

First up, Union Pacific reported earnings per share of $2.51 on revenues of $5.9 billion. That topped estimates of $2.41 in earnings but missed revenue estimates of $6 billion. 🚂

With economic activity slowing and consumers shifting their discretionary spending from goods to services, both pricing and volumes have suffered. And its volume outlook for the fourth quarter was mixed, implying almost no growth.

Amid a slow growth environment, the company is focused on cost management and gaining efficiencies, particularly in operating and safety metrics. ✂️

Meanwhile, CSX Corp. reported similar results. Its earnings per share of $0.42 on revenues of $3.57 billion were mixed vs. estimates of $0.43 and $3.55 billion. 🚃

Intermodal shipments (shipping goods via two or more modes of transport) remained challenged while normalizing export coal benchmark prices negatively offset YoY volume growth. With consumers’ demand for goods expected to remain challenging, the company is also focused on improving profitability. Its operating ratio rose from 59.5% a year ago to 63.8% in the current quarter.

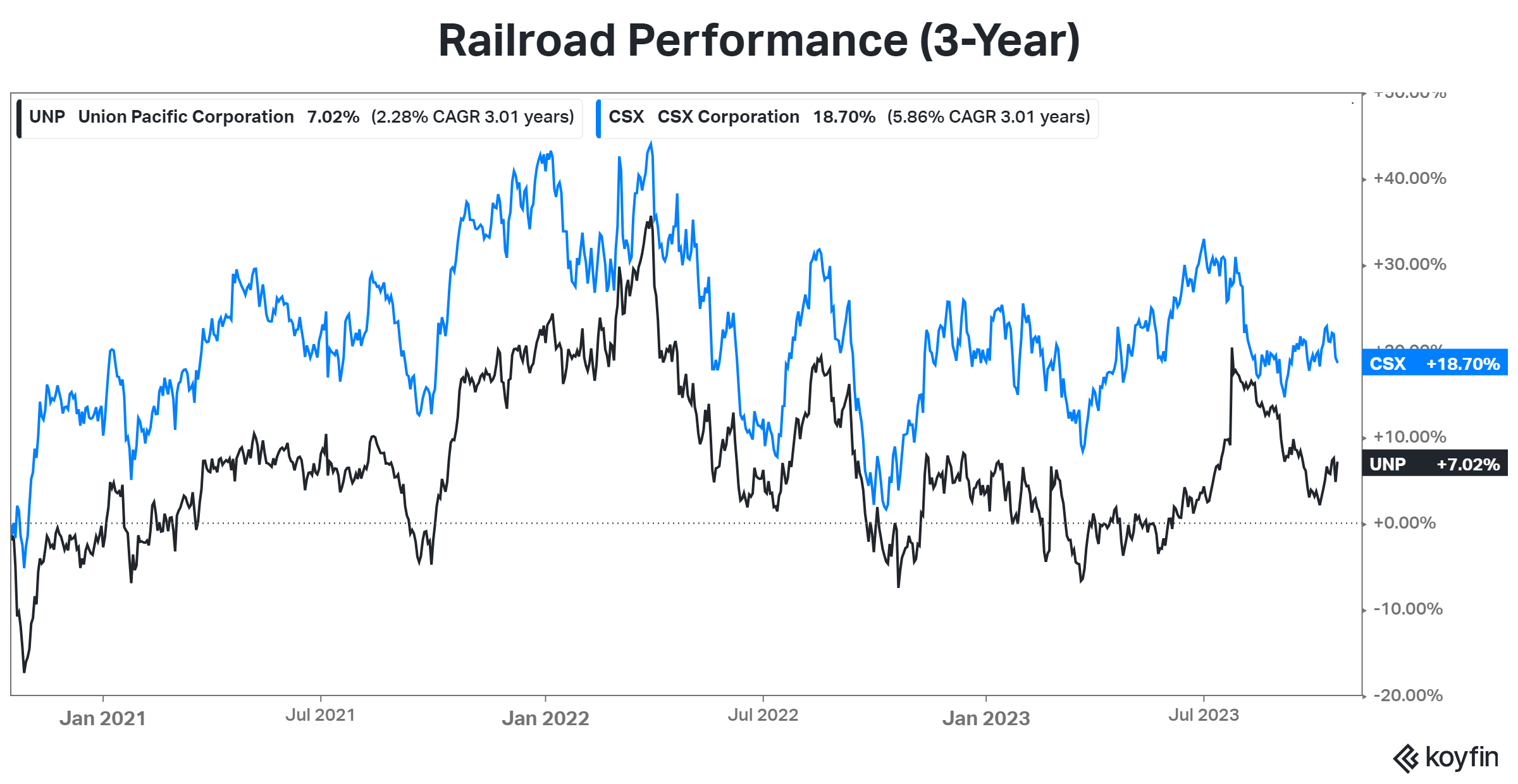

Overall, both railroads were able to beat Wall Street’s low expectations. However, with their stock prices up marginally over the last three years, investors remain concerned about what will get their shares back on track. The consensus is it won’t be economic growth, and cost-cutting can only get you so far. 🤷