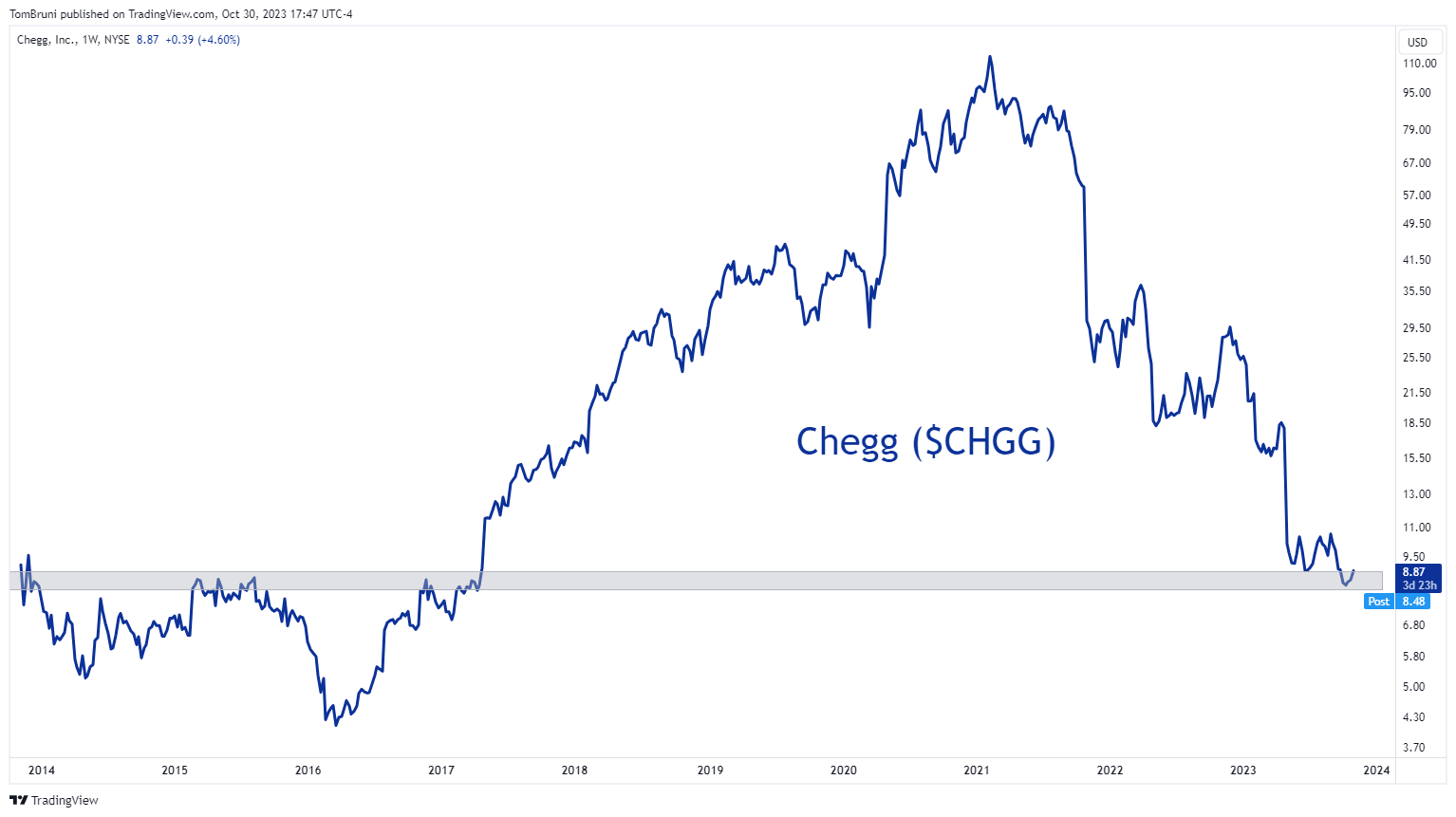

Today, we’re checking in on two popular stocks that often have difficulty around earnings: Pinterest and Chegg. Let’s see how they did. 👀

First, we’ll start with image sharing and social media site Pinterest, which topped third-quarter estimates. Its adjusted earnings per share of $0.28 on revenues of $763.2 million beat the $0.20 and $743.5 million anticipated by analysts. 🔺

Global monthly active users also saw substantial gains, rising 8% YoY to 482 million vs. the 473 million expected. Meanwhile, average revenue per user (ARPU) of $1.61 beat estimates by $0.02. The company also managed to keep expenses in check, rising just 2% to $768.2 million. It’s anticipating fourth-quarter 2023 non-GAAP operating expenses will fall 9%-13% YoY. 📊

The company continues to lean into its differentiators as a visual search, discovery, and shopping platform, delivering stronger results for advertisers. It anticipates its position in the market will continue yielding results, seeing fourth-quarter revenue growth of 11%-13% YoY vs. 11.3% estimates.

Overall, shareholders were happy that advertising on the platform is holding up well despite several industry headwinds weighing on competitors. $PINS shares rose 14% today. 📈

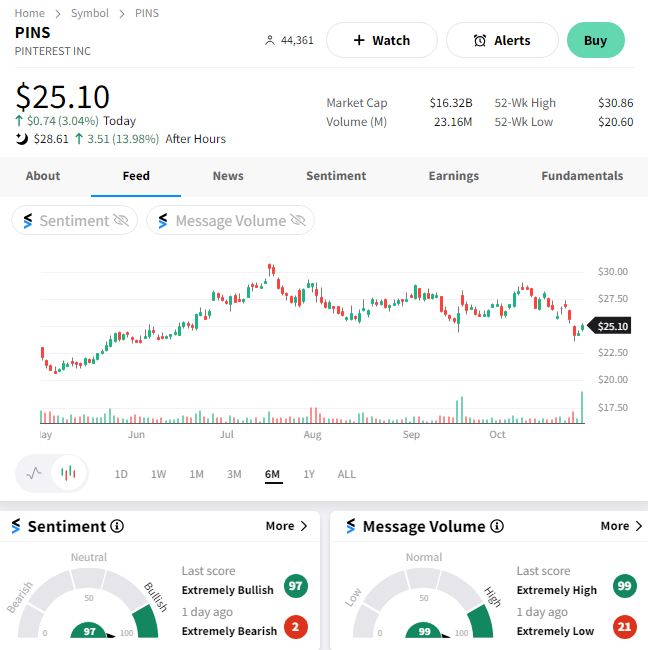

Meanwhile, American education technology company Chegg once again failed to impress. The stock experienced a sharp decline in late 2021 and early 2022 as the “pandemic-era” growth it experienced slowed significantly. It also dropped heavily earlier this year after it warned that Chat-GPT and other generative AI tools materially impacted its market share. 🤖

Most recently, the stock has been on investors’ radars as it looks to stabilize at its post-IPO price in the high single digits. However, overall concerns remain despite the company posting better-than-expected third-quarter results (and meeting guidance).

The company’s service subscribers fell roughly 8% YoY to 4.4 million, with free cash flow down 83% QoQ to $9.37 million. Investors remain skeptical that the company can transform itself into the hyper-personalized, on-demand tool that its customers expect in today’s day and age.

$CHGG shares fell nearly 5% after hours, eliminating their regular-session gains. ⏪