Retail brokerage Robinhood is back in the news after another earnings miss that’s sending shares lower after hours. 👎

A loss per share of $0.09 was lighter than the $0.10 expected, but its revenues of $467 million came in below the $480 million consensus estimate.

Transaction-based revenues fell 11% YoY to $185 million. Within that, equities trading revenue fell 13% to $27 million, while crypto fell 55% to $23 million. A bright spot was options trading, which was unchanged at $124 million. Monthly active users also fell more than anticipated, coming in at 10.3 million vs. the 10.76 million expected. 📉

Its saving grace remains its net interest revenues, which nearly doubled YoY to $251 million thanks to a higher interest rate environment. The company has been working hard to increase its base of “sticky” assets, offering retirement accounts and high-yield offerings to compete for deposits.

To help declining trading revenues and active users, it’s planning to launch U.K. brokerage services in the coming weeks. It also raised its 2023 operating expense estimate slightly to $2.399-$2.439 billion. 🔺

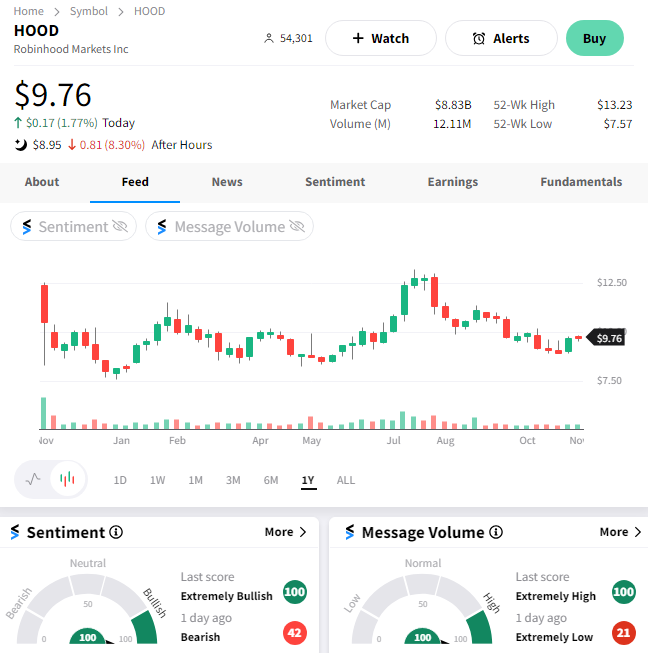

Investors remain concerned about the company’s ability to drive revenue growth and deliver consistent profitability in the current environment. As a result, $HOOD shares are down about 8% after hours and remain stuck in a roughly 18-month trading range. 😴