Monday’s can be rough, especially if you’re a pandemic-era software stock that isn’t growing enough to satisfy Wall Street. Luckily for Monday.com, it was able to hurdle over estimates and rise 11%. 👍

The work management platform reported adjusted earnings per share of $0.15, up from last year’s $0.51 loss. Meanwhile, revenues of $189.2 million topped the $182.5 million expected.

Looking ahead, the company now expects 2023 revenues of $723-$725 million and adjusted operating income of $47-$49 million. That was up from its previous forecast and was enough to get analysts excited that the company may have cut enough costs and stabilized its core business. 🔺

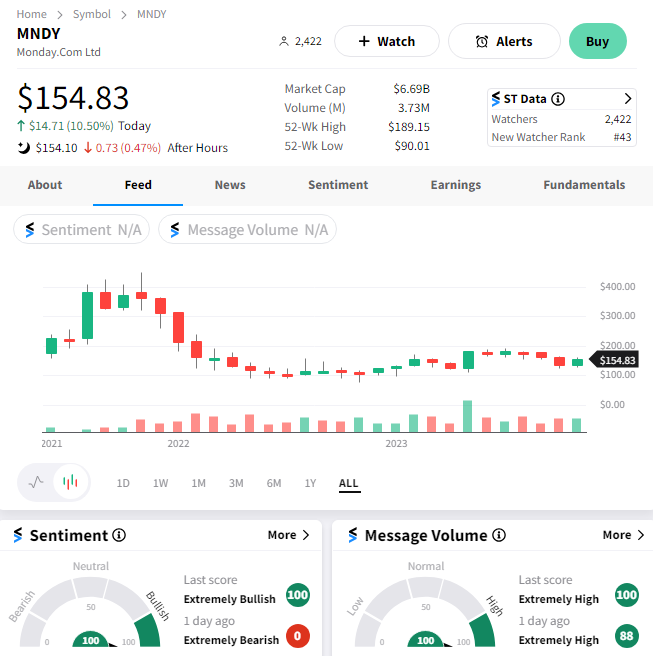

$MNDY shares rose 11% but remain stuck in an 18-month trading range and well off all-time highs above $400. 📊